The NDOG/NWOG Indicator is designed to identify and plot Opening Gaps for the TradingView platform.

This TradingView liquidity indicator provides a new and distinct approach to understanding the significance of these gaps using the ICT analytical style.

In the ICT methodology, these areas are considered Support and Resistance zones. Prices are expected to often return to these areas and react to them.

Specifications of the Daily/Weekly Opening Gap Indicator

The information in the table below details the settings of the Daily/Weekly Gap Opening Indicator:

Indicator Categories: | ICT Tradingview Indicators Supply & Demand Tradingview Indicators Liquidity Tradingview Indicators |

Platforms: | Trading View Indicators |

Trading Skills: | Advanced |

Indicator Types: | Reversal Tradingview Indicators |

Timeframe: | Multi-Timeframe Tradingview Indicators |

Trading Style: | Intraday Tradingview Indicators Swing Trading Tradingview Indicators |

Trading Instruments: | TradingView Indicators in the Forex Market Stock Tradingview Indicators Commodity Tradingview Indicators Share Stocks Tradingview Indicators |

NDOG/NWOG Indicator Overview

This indicator precisely plots Daily Opening Gaps (NDOG) and Weekly Opening Gaps (NWOG) on the chart using light blue and yellow boxes.

- Daily Opening Gap (NDOG): This represents the price difference between the close of the previous day and the opening of the current day;

- Weekly Opening Gap (NWOG): Represents the price difference between Friday's close and Sunday's open.

Performance in an Uptrend

The USD/NZD price chart in the 4-hour timeframe demonstrates the indicator's performance in an uptrend. The indicator plots the Weekly Opening Gap (NWOG) using a yellow box, and after the price returns to this area, it reacts and begins an uptrend.

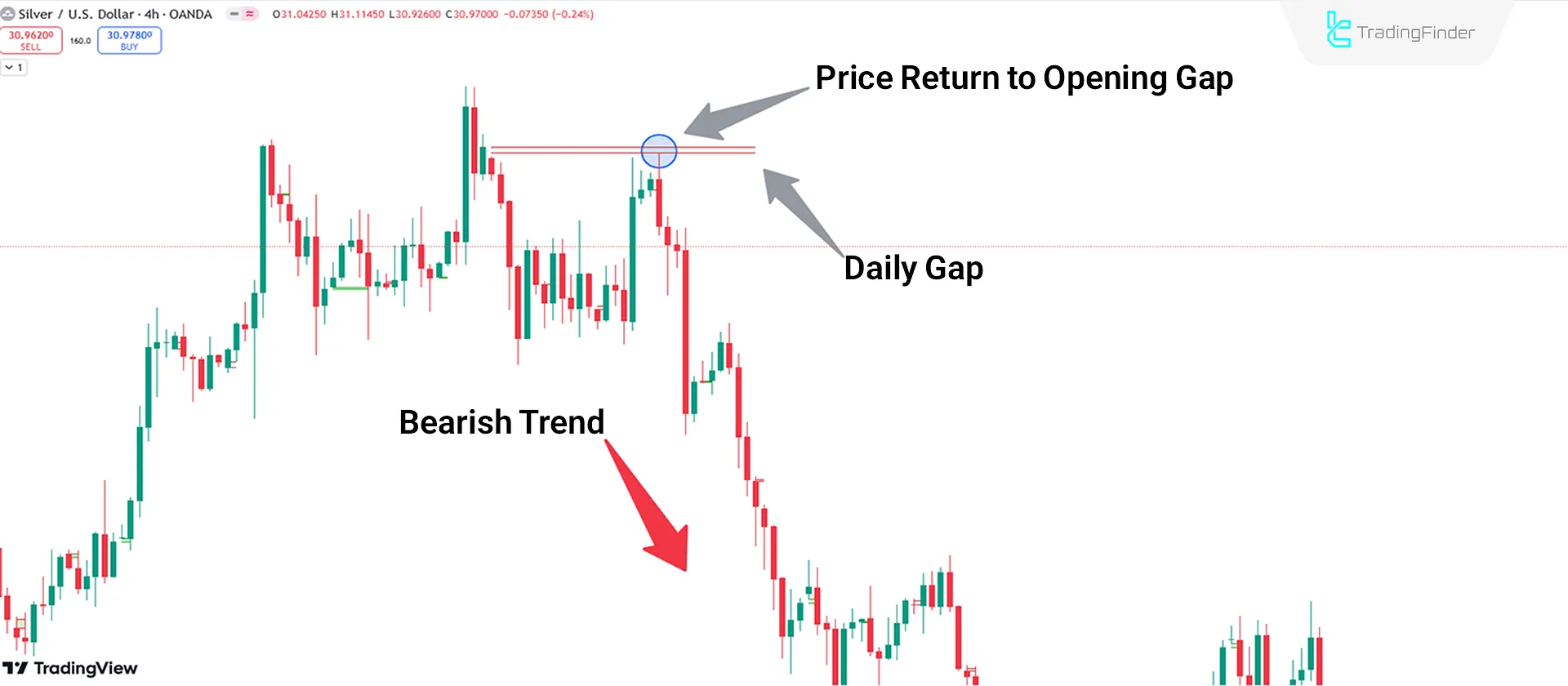

Performance in a Downtrend

Using a light blue box, the indicator displays the Daily Opening Gap (NDOG) on the Silver/U.S. Dollar chart in the 4-hour timeframe. It resumes a downtrend after the price returns and interacts with the gap.

Indicator Settings

Reviewing the settings of the "NDOG/NWOG" indicator as shown below:

Daily Range

Daily RangeMonthly Range

- Show Daily Opening Range: Display daily opening gaps

- Max Opening Range Update Method: Method for updating the daily opening range

- Max Opening Range Update: The maximum number of updates allowed is 5

Weekly Range

- Show Weekly Opening Range: Display weekly opening gaps

- Max Opening Range Update Method: Method for updating the weekly opening range

- Max Opening Range Update: The maximum number of updates allowed is 4

Monthly Range

- Show Monthly Opening Range: Display monthly opening gaps

- Max Opening Range Update Method: Method for updating the monthly opening range

- Max Opening Range Update: The maximum number of updates allowed is 12

Conclusion

The Daily and Weekly Opening Gap Indicator (NDOG/NWOG) plots the price differences between a trading symbol's opening and closing prices on a daily, weekly, and monthly scale.

Prices often return to these gaps and fill them, presenting favorable opportunities for entering trades. Price gaps (particularly in the ICT trading style) are also considered Support and Resistance zones. Also, this trading tool belongs to the supply and demand indicators category.

New Daily/Weekly Opening Gap TradingView PDF

New Daily/Weekly Opening Gap TradingView PDF

Click to download New Daily/Weekly Opening Gap TradingView PDFDoes this indicator display monthly gaps?

Yes, the indicator also displays monthly gaps by enabling the "Show Monthly Opening Range" option in the settings.

What are the uses of price gaps?

Prices tend to return to them and usually resume the prior trend after filling the gaps.