Cayman Islands Monetary Authority is one the well-known offshore Forex broker regulators that licenses and supervises companies that offer services to international traders.

This authority mandates funds segregation, CI$100,000 minimum capital, and advises brokers to set negative balance protection for their users. Here are the best brokers both regulated or not regulated by CIMA.

| Vantage | |||

| HYCM | |||

| EBC Financial Group | |||

| 4 |  | MultiBank Group | ||

| 5 |  | AvaTrade | ||

| 6 |  | D Prime | ||

| 7 |  | XM Group | ||

| 8 |  | Deriv |

Trustpilot Ratings of Forex Brokers (CIMA-regulated and Not Regulated)

The table below contains the Trustpilot ratings of the best Forex brokerages both licensed and not licensed by Cayman Islands Monetary Authority.

Broker | Trustpilot Rating | Number of Reviews |

AvaTrade | 4.8/5 ⭐ | 11500+ |

MultiBank Group | 4.6/5 ⭐ | 1500+ |

Deriv | 4.4/5 ⭐ | 70000+ |

4.4/5 ⭐ | 11500+ | |

3.7/5 ⭐ | 50+ | |

XM Group | 3.1/5 ⭐ | 3000+ |

D Prime | 2.6/5 ⭐ | 400+ |

HYCM | 1.5/5 ⭐ | 100+ |

Minimum Spreads of Forex Brokers (Both CIMA-Regulated and Not Regulated)

Spreads are the main costs of trading with a Forex broker. Here are the best brokers with lowest spreads.

Brokers | Minimum Spreads |

0.0 Pips | |

Mitrade | 0.0 Pips |

Tradeview Markets | 0.0 Pips |

EBC Financial Group | 0.0 Pips |

Vantage | 0.0 Pips |

HYCM | 0.1 Pips |

0.8 Pips | |

Forex.com | 0.8 Pips |

Non-Trading Fees in Forex Brokers Regulated by CIMA (Unregulated Brokers Considered)

Considering the non-trading fees such as deposit, withdrawal, and inactivity costs are important because they add up to the overall costs of trading with a Forex broker.

The table below provides a comparison of these fees in CIMA-regulated brokers and unregulated brokers.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Vantage | $0 | $0 | $0 |

$0 | Mostly $0 | $10 | |

HYCM | $0 | $0 | $10 |

$0 | $0 | $25 | |

IC Markets | $0 | $0 | $0 |

FXGrow | $0 | $0 | $0 |

MultiBank Group | $0 | $0 | $60 |

FxPro | $0 | $0 | $15 |

Number of Tradable Instruments in Forex Brokers Regulated or Not Regulated by CIMA

Having access to a wide variety of tradable assets allows you to diversify your portfolio and take advantage of opportunities that occur in different markets.

Broker | Number of Tradable Assets |

MultiBank Group | 20000+ |

10000+ | |

Forex.com | 7000+ |

1250+ | |

Tradeview Markets | 1000+ |

Vantage | 1000+ |

HFM | 500+ |

EBC Financial Group | 200+ |

Top 8 Forex Brokers Regulated by CIMA (Not CIMA-Regulated Brokers Included)

International traders who are looking for a safe and regulated brokers, can choose from the available options licensed and regulated by the Cayman Islands Monetary Authority to trade Forex, stocks, CFDs, bonds, etc.

Vantage

Vantage Markets is a multi-jurisdictional online brokerage established in 2009, with headquarters in Sydney and an operational footprint spanning more than 30 international offices.

The firm provides access to a broad range of asset classes, including Forex, CFDs on indices, commodities, shares, ETFs, and cryptocurrencies, positioning itself as a multi-asset trading venue rather than a niche broker.

From a platform perspective, Vantage Markets supports MetaTrader 4, MetaTrader 5, TradingView, ProTrader, and a proprietary mobile application, covering both discretionary and automated trading workflows.

Algorithmic trading via Expert Advisors, advanced charting, multi-timeframe analysis, and VPS hosting are core components of its technical infrastructure.

On the regulatory side, Vantage operates through several legal entities, including ASIC (Australia), FCA (United Kingdom), FSCA (South Africa), VFSC, and CIMA.

This structure results in varying leverage limits, investor protection frameworks, and client eligibility rules across regions, with features such as segregated client funds and negative balance protection applied at entity level.

Account configurations after completing Vantage registration include Standard STP, Standard Cent, Raw ECN, Pro ECN, and Swap-Free (Islamic) accounts, with spreads starting from 0.0 pips on ECN models and commissions scaling based on account type.

For non-trading functionality, the broker supports multiple base currencies, low entry deposits (from $20), and a wide selection of funding methods.

In terms of passive participation, Vantage integrates third-party copy and social trading services such as ZuluTrade, DupliTrade, and Myfxbook AutoTrade, enabling strategy replication without direct trade execution.

Overall, Vantage Markets operates as a feature-dense brokerage whose offering is shaped primarily by regulatory scope, platform diversity, and account-level customization rather than promotional positioning.

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap-Free (Islamic) |

Regulating Authorities | ASIC (Australia), FCA (UK), FSCA (South Africa), VFSC (Vanuatu), CIMA (Cayman Islands) |

Minimum Deposit | From $20 (varies by account type) |

Deposit Methods | Credit/Debit Cards, Bank Wire, E-Wallets (Skrill, Neteller, Perfect Money), Local Payment Methods |

Withdrawal Methods | Credit/Debit Cards, Bank Wire, E-Wallets, Local Payment Options (method availability depends on region) |

Maximum Leverage | Up to 1:1000 (entity- and jurisdiction-dependent) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, ProTrader, Vantage Proprietary App |

Vantage Pros and Cons

The table below covers all the benefits and limitations of trading with the Vantage broker.

Pros | Cons |

Multi-regulatory structure with oversight from ASIC, FCA, FSCA, VFSC, and CIMA | Investor protection level varies significantly between onshore and offshore entities |

Broad platform coverage including MT4, MT5, TradingView, ProTrader, and a proprietary app | No proprietary desktop platform; custom tools are mainly web or mobile-based |

ECN account models with raw spreads starting from 0.0 pips | - |

Integrated copy trading via ZuluTrade, DupliTrade, and Myfxbook AutoTrade | - |

Multibank Group

MultiBank Group is a global brokerage established in 2005 that operates as a multi-asset trading provider across Forex, commodities, indices, shares, and cryptocurrency CFDs.

From a regulatory perspective, MultiBank functions under a broad, multi-jurisdictional framework that includes oversight from ASIC, CySEC, MAS, BaFin, CIMA, and the BVI FSC, among others. All entities require MultiBank verification to comply with AML laws.

Client protection mechanisms vary by entity but generally include segregated client funds, negative balance protection in select regions, and excess loss insurance coverage of up to USD 1,000,000 per account.

MultiBank supports several trading environments through MetaTrader 4, MetaTrader 5, and its proprietary MultiBank-Plus platform, offering access to automated trading, ECN execution, and multi-market exposure.

Account structures are segmented into Standard, Pro, and ECN models, with leverage reaching up to 1:500 depending on regulatory jurisdiction and spreads starting from 0.0 pips on ECN accounts, typically without commission.

Operationally, the broker applies jurisdiction-based service restrictions, excluding residents of countries such as the United States, the United Kingdom, Iran, Russia, and North Korea from completing the MultiBank registration process.

Funding is facilitated through bank transfers, cards, SEPA, and cryptocurrencies on the MultiBank dashboard, while non-trading costs are limited, aside from an inactivity fee after prolonged dormancy.

Overall, MultiBank positions itself as a regulation-heavy, infrastructure-driven brokerage focused on scale, capital protection, and institutional-style trading access rather than research-led or education-centric services.

Account Types | Standard, Pro, ECN |

Regulating Authorities | ASIC (Australia), CySEC (Cyprus), MAS (Singapore), BaFin (Germany), CIMA (Cayman Islands), BVI FSC, AUSTRAC, SCA (UAE), VARA |

Minimum Deposit | From 50 USD (varies by account type and entity) |

Deposit Methods | Credit and debit cards, bank wire transfer, SEPA, cryptocurrencies (BTC, USDT), local payment methods |

Withdrawal Methods | Bank wire transfer, credit and debit cards, e-wallets such as Neteller, cryptocurrency withdrawals |

Maximum Leverage | Up to 1:500 (depending on regulatory entity and client jurisdiction) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, MultiBank-Plus, WebTrader MT4 |

Pros and Cons of MultiBank Group

The table below contains the advantages and disadvantages of trading with the MultiBank Group broker.

Pros | Cons |

Broad multi-regulatory coverage across Asia, Europe, Australia, and the Middle East | Trading conditions vary noticeably between regulated entities |

High maximum leverage available under offshore and selected international entities | Relatively high minimum deposit on Pro and ECN account types |

Commission-free trading model across Standard, Pro, and ECN accounts | Limited in-house research and educational content |

Support for multiple platforms including MT4, MT5, and MultiBank-Plus | Inactivity fee applies after prolonged periods without trading ($60) |

HYCM

HYCM, also known as Henyep Capital Markets, operates as a multi-entity brokerage group with differentiated supervision across the United Kingdom and the United Arab Emirates.

The UK-facing entity, HYCM Capital Markets (UK) Limited, is authorized by the Financial Conduct Authority (FCA), while HYCM Capital Markets (DIFC) Limited is supervised by the Dubai Financial Services Authority (DFSA) and CIMA.

Traders must complete HYCM verification to comply with international AML and CFT laws in each entity.

Trading access is delivered through MetaTrader 4, MetaTrader 5, and the HYCM Trader mobile app after finalizing HYCM registration, with execution offered via Market Execution and Instant Execution depending on instrument and account configuration.

HYCM structures its core offering around three primary account types: Fixed, Classic, and RAW. Across these accounts, the minimum deposit is set at $20, base currencies include USD, EUR, GBP, AED, and JPY, and minimum order size starts at 0.01 lot.

Cost parameters vary by model: RAW pricing is designed around floating spreads from 0.1 pips with commissions ranging from $0 to $5 per round, while Fixed and Classic are positioned as commission-free structures with wider floating spreads.

Client safeguards differ by jurisdiction. Under the FCA framework, eligible clients may fall under the Financial Services Compensation Scheme (FSCS) up to GBP 85,000, alongside segregated funds and negative balance protection.

HYCM also applies segregated fund handling and negative balance protection across entities, with leverage limits ranging from 1:30 under FCA to up to 1:500 in other jurisdictions.

Operationally, this broker supports Visa/MasterCard, PayPal, bank wire, Neteller, and Skrill for HYCM deposits and withdrawals, and maintains a restricted-country list including the USA, Canada, France, Belgium, North Korea, Sudan, Syria, and Afghanistan.

Account Types | Fixed, Classic, RAW, Demo, Islamic |

Regulating Authorities | Financial Conduct Authority (FCA), Dubai Financial Services Authority (DFSA), Saint Vincent & the Grenadines, CIMA |

Minimum Deposit | $20 |

Deposit Methods | Visa/MasterCard, PayPal, Bank Wire, Neteller, Skrill, Perfect Money, Fasapay, WebMoney, Crypto (BTC, USDT) |

Withdrawal Methods | Visa/MasterCard, PayPal, Bank Wire, Neteller, Skrill, WebMoney, Crypto (BTC, USDT) |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, HYCM Trader |

HYCM Pros and Cons

Traders must consider the following benefits and drawbacks before opening an account with HYCM.

Pros | Cons |

Regulation under FCA (UK) and DFSA (UAE) provides structured oversight and defined compliance standards | EU clients are no longer accepted following the termination of the CySEC license |

Low minimum deposit starting from 20 USD across all main account types | Educational and research resources are limited compared to research-focused brokers |

Multiple account models including Fixed, Classic, and RAW with flexible pricing structures | Copy trading and social trading features are not directly supported |

Access to MT4, MT5, and a proprietary mobile trading application | - |

EBC Financial Group

EBC Financial Group is a relatively young brokerage established in London in 2020, positioning itself as a technology-driven provider focused on execution quality and institutional-style pricing.

EBC Financial Group registration access to more than 100 tradable instruments across Forex, commodities, index CFDs, stock CFDs, and ETFs, with leverage generally capped at 1:500 depending on jurisdiction and client classification.

Under specific conditions, eligible accounts may apply for higher leverage structures tied to equity thresholds.From a regulatory standpoint, EBC operates through multiple legal entities.

These include oversight by the Financial Conduct Authority in the United Kingdom, the Australian Securities and Investments Commission, CIMA, and the Financial Services Commission of Mauritius, alongside offshore registrations such as the SVGFSA.

Client protections therefore vary by entity, ranging from FSCS coverage for UK clients to segregated funds and negative balance protection in other regions.

Trading is supported through MetaTrader 4 and MetaTrader 5, with infrastructure reportedly connected to liquidity providers such as J.P. Morgan, Barclays, and UBS, enabling sub-20ms execution in optimal conditions.

Account structures are limited to Standard and Professional models, with spreads starting around 1.1 pips on Standard accounts. Traders can lower costs by leveraging EBC Financial Group rebates.

Beyond execution, EBC integrates copy trading and PAMM solutions, trading challenges, and affiliate programs.

The group has also emphasized brand visibility through partnerships, including collaborations with market figures such as Joe DiNapoli and a multi-year association with FC Barcelona.

Operational constraints include a defined list of restricted countries and a relatively high entry threshold compared to low-deposit retail brokers.

Account Types | Standard, Professional |

Regulating Authorities | FCA (United Kingdom), ASIC (Australia), CIMA (Cayman Islands), FSC Mauritius, SVGFSA |

Minimum Deposit | From 100 USD (5,000 USD for Professional account) |

Deposit Methods | Local bank transfers, international bank wire, Visa, MasterCard, UnionPay, Skrill, SticPay, 1BitPay, Binance Pay, ChipPay, cryptocurrency (USDT TRC20 / ERC20) |

Withdrawal Methods | Local bank transfers, international bank wire, Visa, MasterCard, UnionPay, Skrill, SticPay, 1BitPay, Binance Pay, ChipPay, cryptocurrency |

Maximum Leverage | Up to 1:500 (higher leverage available for eligible accounts under specific conditions) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

EBC Financial Group Pros and Cons

The table below provides an overview of the benefits and drawbacks of trading with EBC Financial Group.

Pros | Cons |

Regulation across multiple jurisdictions including FCA, ASIC, and CIMA | Limited number of account types compared to multi-tier retail brokers |

Raw spread pricing available on Professional accounts | Higher minimum deposit required for Professional account access |

Fast execution infrastructure supported by tier-one liquidity providers | Geo-restrictions limit availability in several major regions |

Support for copy trading and PAMM investment structures | - |

AvaTrade

AvaTrade operates as a multi-asset brokerage firm under the supervision of several regulatory authorities, including ASIC, CySEC, CBI, FSA, FSCA, ADGM, BVI FSC, and ISA, while also aligning with the European MiFID II framework.

This regulatory footprint spans jurisdictions such as Ireland, Australia, Japan, South Africa, Cyprus, and the United Arab Emirates, establishing region-specific compliance structures.

Client fund protection mechanisms are implemented through segregated accounts and Negative Balance Protection, with compensation coverage of up to €20,000 available under the Investor Compensation Fund (ICF) for eligible EU-based accounts.

Maximum leverage levels vary depending on the regulatory jurisdiction after completing the AvaTrade registration, ranging from 1:25 in Japan to 1:400 in offshore regions, reflecting differing retail risk controls.

The broker supports account categories such as Retail, Professional, Islamic (Swap-Free), and Demo, with a minimum deposit requirement of $100.

AvaTrade deposit and withdrawal operations are facilitated via multiple channels, including credit/debit cards, bank wire transfers, Skrill, Neteller, WebMoney, and PayPal, depending on regional availability.

Margin call and stop-out thresholds are set at 25% and 10%, respectively. Trading access is provided through platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), proprietary WebTrader, mobile trading applications, and AvaOptions for FX options.

Available markets include Forex, Stocks, Commodities, Indices, Metals, and Cryptocurrency CFDs, with order execution handled via an instant execution model.

Additional services such as DupliTrade and AvaSocial enable copy trading functionality are available on the AvaTrade dashboard.

Account Types | Retail, Professional, Islamic (Swap-Free), Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, ADGM, BVI FSC, ISA, MiFID II |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, Bank Wire Transfer, Skrill, Neteller, WebMoney, PayPal |

Withdrawal Methods | Credit/Debit Cards, Bank Wire Transfer, Skrill, Neteller, WebMoney, PayPal |

Maximum Leverage | Up to 1:400 (depending on jurisdiction) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, Mobile App, AvaOptions |

AvaTrade Pros and Cons

The table below outlines the benefits and drawbacks of trading with AvaTrade broker.

Pros | Cons |

Regulated by multiple authorities including ASIC, CySEC, and CBI | Inactivity fee applied after 2 months of no trading activity |

Supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and AvaOptions | No PAMM account offering |

Segregated client funds and Negative Balance Protection | Maximum leverage limited to 1:30 in EU jurisdictions |

Access to copy trading via DupliTrade and AvaSocial | Support services not available 24/7 |

XM Group

Established in 2009, XM Group provides CFD-based trading services across a multi-asset environment, supporting more than 55 Forex pairs and over 1,200 stock CFDs.

The broker reports a global client base exceeding 15 million accounts and processes approximately 14 million trades daily through operational hubs in Cyprus, South Africa, Dubai, and Belize.

XM functions under a network of regulated entities, including oversight from CySEC, DFSA, FSCA, FSC, FSC Mauritius, and FSA Seychelles.

In the Middle East, promotional activities are conducted via XM Financial Products Promotion L.L.C, licensed by the Securities and Commodities Authority (SCA), while Trading Point MENA Limited operates under DFSA license F003484.

Traders must complete the XM Group verification process to use the brokerage services in any given entities.

Trading infrastructure is limited to the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available across desktop, web, and mobile interfaces all available for download on the XM Group dashboard.

XM supports account types such as Standard, Ultra Low, and Shares, with a base minimum deposit of $5 (excluding the Shares account).

Margin call and stop-out thresholds are defined at 50% and 20%, respectively, and leverage can extend up to 1:1000 depending on jurisdiction.

Available markets include Forex, Precious Metals, Indices, Commodities, Cryptocurrency CFDs, and Equity CFDs, all tradable with a minimum order size of 0.01 lot.

Additional integrated features such as MQL5 Signal Service and XM Group copy trading are supported. User sentiment remains mixed, with ratings of 3.1/5 on Trustpilot.

Account Types | Micro, Standard, Ultra Low, Shares |

Regulating Authorities | CySEC, DFSA, FSCA, FSC (Belize), FSC (Mauritius), FSA (Seychelles) |

Minimum Deposit | $5 (Standard, Micro, Ultra Low) |

Deposit Methods | Credit/Debit Cards, Bank Wire Transfer, Skrill, Neteller, Perfect Money, Apple Pay, Google Pay |

Withdrawal Methods | Credit/Debit Cards, Bank Wire Transfer, Skrill, Neteller, Perfect Money |

Maximum Leverage | Up to 1:1000 (depending on jurisdiction) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), XM Mobile App |

Pros and Cons of XM Group

The table below outlines the benefits and drawbacks of trading with the XM Group broker.

Pros | Cons |

Low minimum deposit starting from $5 | Inactivity fee charged on dormant accounts |

Regulated by CySEC, DFSA, FSCA, FSC, and FSA | Services restricted in regions such as the U.S. and Canada |

Access to 1,400+ CFD instruments across multiple markets | No PAMM account support |

Negative Balance Protection for retail clients | Limited platform support to MT4 and MT5 only |

D Prime

Operating under the legal entity D Prime Limited since December 2014, D Prime provides brokerage services across multiple CFD asset classes, including Forex, Cryptocurrencies, Metals, Commodities, Stock Indices, Futures, and Securities.

The firm reports a client base exceeding 400,000 active users, supported by a global network of over 37,000 Introducing Brokers (IBs).

D Prime maintains regulatory registrations through VFSC (Vanuatu Financial Services Commission) and the FSC (Mauritius), with regional operations structured under entities such as D Prime Vanuatu Limited and D Prime Mauritius Limited.

Depending on jurisdiction, client protection mechanisms may include segregated funds or Negative Balance Protection, although compensation schemes are not uniformly available across all branches.

Traders must complete D Prime verification to be eligible for these client protection mesures.

The broker supports three live account structures, including Cent, STP, and ECN, offering leverage of up to 1:1000.

While the Cent account may be accessed without initial capital requirements, the STP and ECN accounts typically involve a minimum deposit of $100 and permit position sizing up to 100 standard lots.

Market execution is applied across all account types, with spreads starting from 0.0 pips on ECN configurations.

Trading infrastructure includes MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary D Prime InTrade platform, with additional integrations such as Trading Central, Economic Calendar, and VPS hosting.

Automated investment modules including PAMM, MAM, FOLLOWME, and CopyTrading are also supported in the D Prime dashboard.

After D Prime registration, Funding and withdrawal channels encompass local bank transfers, international wire transfers, credit/debit cards, and selected e-wallets, with no internal fees applied to standard account transactions.

Account Types | Cent, STP, ECN |

Regulating Authorities | VFSC, FSC (Mauritius) |

Minimum Deposit | $0 (Cent), $100 (STP & ECN) |

Deposit Methods | Local Bank Transfers, International Wire Transfer, Credit/Debit Cards, E-wallets |

Withdrawal Methods | Local Bank Transfers, International Wire Transfer, Credit/Debit Cards, E-wallets |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), D Prime InTrade |

D Prime Pros and Cons

Traders must consider the following factors before opening an account with the D Prime broker.

Pros | Cons |

Supports PAMM, MAM, FOLLOWME, and CopyTrading modules | Not regulated by Tier-1 financial authorities |

Offers leverage up to 1:1000 across Cent, STP, and ECN accounts | Investor compensation scheme not available |

Provides MetaTrader 4 (MT4), MetaTrader 5 (MT5), and D Prime InTrade | Negative Balance Protection not available on all entities |

No internal fees on deposits, withdrawals, or inactivity | Educational resources limited to registered users |

Deriv

Founded in 1999 as part of the Regent Markets Group and rebranded in 2020, Deriv provides access to leveraged derivative instruments, including CFDs, Options, and Multipliers across asset classes such as Forex, Stocks, Commodities, Indices, and Cryptocurrencies.

The broker reports more than 2.5 million traders have completed Deriv registration and facilitates over 187 million executed trades per month through its global infrastructure.

Regulatory supervision is distributed across multiple jurisdictions, including the MFSA, FSA, VFSC, BVI FSC.

Regional entities such as Deriv Investments (Europe) Ltd, Deriv (BVI) Ltd, and Deriv (FX) Ltd operate under varying leverage restrictions, with limits ranging from 1:30 in Europe to 1:1000 or higher in offshore jurisdictions.

Trading services are available through platforms including MetaTrader 5 (MT5), cTrader, and the proprietary Deriv X interface, which supports over 110 technical indicators and multiple drawing tools. Account types after completing Deriv verification include Standard, Financial, and Swap-Free are accessible with a minimum deposit requirement starting from $5.

Commission-free pricing structures are applied to most CFD instruments, with floating spreads beginning from approximately 0.24 pips.

Additional functionality includes Copy Trading, MT5 Signals, and synthetic products such as Derived Indices, which may be traded continuously are available on the Deriv dashboard.

Despite these features, CFD trading remains high-risk, with a reported 70.78% of retail investor accounts experiencing losses when trading leveraged products on this platform.

Account Types | Standard, Financial, Swap-Free |

Regulating Authorities | MFSA, FSA (Labuan), VFSC, BVI FSC |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-wallets, Cryptocurrencies, Deriv P2P, Voucher |

Withdrawal Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-wallets, Cryptocurrencies, Deriv P2P |

Maximum Leverage | Up to 1:1000 (depending on entity) |

Trading Platforms & Apps | MetaTrader 5 (MT5), cTrader, Deriv X |

Deriv Pros and Cons

Here are the benefits and drawbacks of trading with Deriv.

Pros | Cons |

Supports CFDs, Options, and Multipliers across multiple asset classes | Not licensed by major Tier-1 regulators such as FCA or ASIC |

Commission-free trading with spreads from 0.24 pips | No PAMM or MAM account infrastructure |

Offers MT5, cTrader, and Deriv X trading platforms | - |

Provides Negative Balance Protection and segregated client funds | - |

How Did we Choose the Best CIMA-Regulated Brokers?

TradingFinder experts have reviewed all the brokers based on the same principals to conduct a fare evaluation and help market participants choose the best available options.

Here are the main aspects we have considered when curating this list:

- Spreads

- Commissions

- Deposit and Withdrawal Methods

- Support Quality

- Leverage

- Regulation

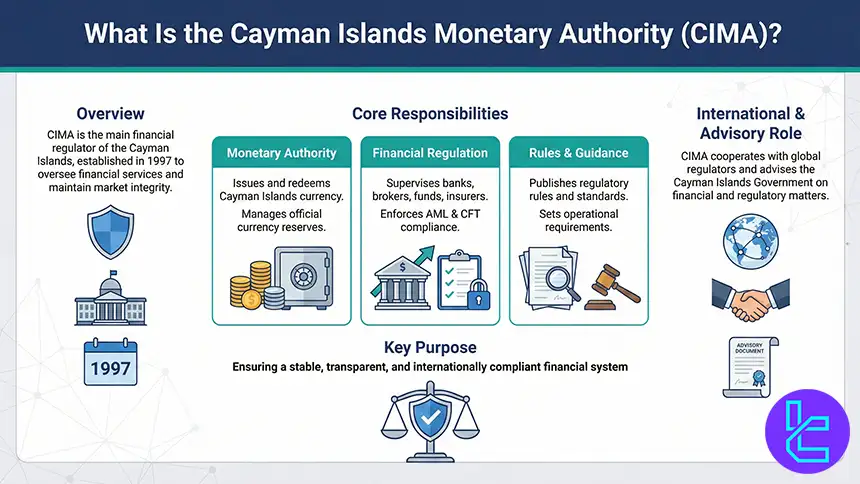

What is CIMA?

The Cayman Islands Monetary Authority (CIMA) is the central regulatory body responsible for overseeing financial services activities conducted in and from the Cayman Islands.

Established in 1997, CIMA plays a core role in maintaining regulatory order, financial stability, and institutional credibility within one of the world’s most prominent offshore financial centers.

CIMA’s mandate extends across multiple dimensions of financial governance. From a monetary standpoint, the authority manages the issuance and redemption of the Cayman Islands currency and oversees official currency reserves.

On the regulatory side, it supervises banks, investment firms, insurance companies, funds, brokers and other licensed financial institutions, while enforcing compliance with anti-money laundering and counter-terrorism financing frameworks.

CIMA also publishes regulatory rules, statements of principle, and supervisory guidance that define operational standards for licensed entities.

Beyond domestic oversight, CIMA acts as a cooperative regulator by working closely with international supervisory authorities.

Through memoranda of understanding, it supports cross-border information sharing and consolidated supervision, which is particularly relevant given the global nature of financial groups operating in the Cayman Islands.

In addition, the authority serves an advisory function by providing policy guidance to the Cayman Islands Government on monetary, regulatory, and supervisory matters.

Overall, CIMA’s role is centered on safeguarding the integrity of the Cayman Islands financial system, aligning local practices with international regulatory standards, and supporting a stable, transparent, and well-supervised financial environment.

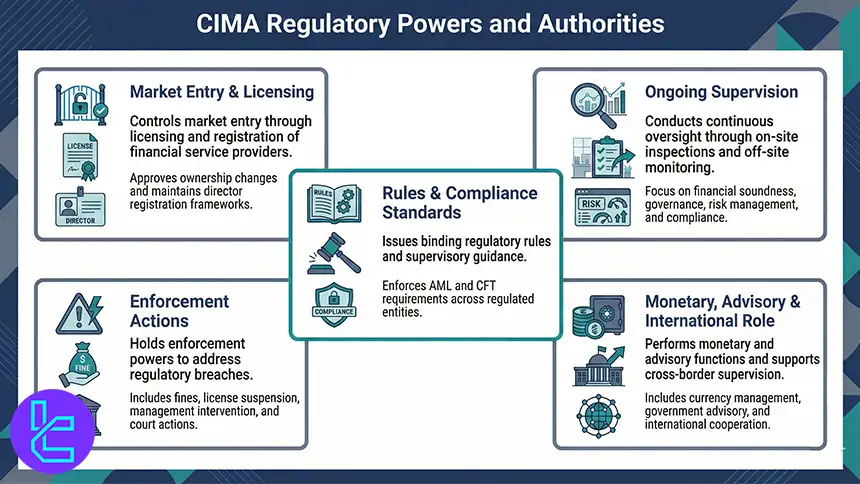

What Powers Cayman Islands Monetary Authority Holds?

The Cayman Islands Monetary Authority (CIMA) exercises a broad range of statutory powers designed to regulate, supervise, and safeguard financial services activities within its jurisdiction.

These powers allow CIMA to act both as a gatekeeper at the point of market entry and as an ongoing supervisory authority throughout the lifecycle of regulated entities.

At the licensing stage, CIMA controls who may operate in the Cayman Islands financial sector.

It approves and registers financial service providers, oversees changes in ownership or control, and maintains director registration frameworks for regulated funds, including directors located outside the Cayman Islands.

From a supervisory perspective, CIMA conducts continuous oversight through a combination of off-site monitoring and on-site inspections.

These reviews focus on financial soundness, internal controls, risk management practices, and adherence to regulatory obligations.

CIMA also issues binding regulatory Rules and Statements of Guidance, setting enforceable standards for conduct, governance, and operational resilience.

A central part of this oversight involves enforcing Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) requirements.

CIMA’s enforcement powers allow it to respond decisively to regulatory breaches. These include imposing administrative fines, suspending or revoking licenses, restricting business activities, and intervening in management structures when necessary.

In serious cases, CIMA may apply to the Grand Court for remedies such as winding-up orders or seek disgorgement to prevent unlawful gains.

In addition, CIMA performs monetary and advisory functions by managing the Cayman Islands currency and advising the government on regulatory and supervisory matters.

Through international cooperation agreements, it also supports cross-border supervision and perimeter policing, including investigations into unlicensed financial activity.

Do CIMA-Regulated Brokers offer Negative Balance Protection?

Negative Balance Protection (NBP) is commonly available among brokers regulated by the Cayman Islands Monetary Authority (CIMA), although it is not imposed as a blanket regulatory obligation in the same way it is under the European ESMA framework.

In practice, NBP under CIMA operates as a broker-level safeguard rather than a universal statutory requirement.

Many CIMA-licensed brokers choose to provide Negative Balance Protection as part of their internal risk controls or client-protection policies.

This approach is particularly prevalent among internationally recognized firms that aim to align their offshore entities with higher global standards.

NBP is typically designed for retail traders, while professional or institutional clients may be excluded due to their higher risk tolerance and experience.

Alongside NBP, CIMA places strong emphasis on structural protections, including the segregation of client funds and the implementation of comprehensive risk management systems.

Overall, while CIMA does not mandate Negative Balance Protection at a regulatory level, its supervisory framework encourages brokers to adopt measures that limit systemic risk and protect retail clients from excessive losses.

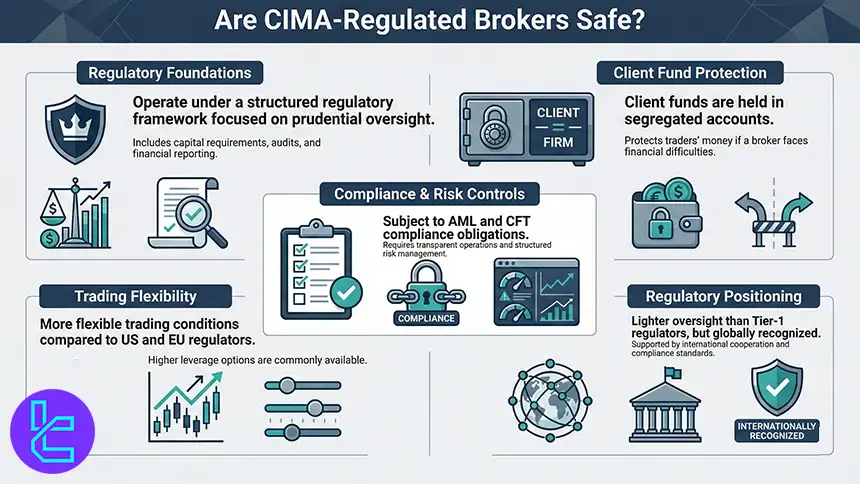

Are CIMA-Regulated Brokers Safe?

Brokers licensed by the Cayman Islands Monetary Authority operate within a regulatory framework that is generally regarded as suitable for experienced traders seeking flexible trading conditions.

CIMA supervision requires licensed firms to follow core prudential standards, including the segregation of client funds, minimum capital thresholds, and periodic financial reporting supported by independent audits.

From a client-protection perspective, segregated accounts are a central safeguard, ensuring that customer funds remain separate from a broker’s operational capital in the event of financial distress.

In parallel, CIMA enforces compliance with international AML and CFT regulations, obliging brokers to maintain structured risk controls and transparent operational procedures.

The Cayman Islands regulatory environment is often described as business-oriented rather than restrictive.

Unlike US or EU jurisdictions, where leverage limits and product rules are tightly standardized, CIMA allows brokers greater discretion in setting trading conditions.

As a result, higher leverage offerings are common, which can appeal to traders with advanced risk management experience.

While the regulatory approach is lighter than that of Tier-1 authorities such as the FCA or SEC, the Cayman Islands remains a well-established and globally recognized financial center.

Its credibility is supported by long-standing international cooperation agreements and adherence to global compliance standards.

Overall, CIMA-regulated brokers combine baseline regulatory protections with operational flexibility, making them a practical option for traders who understand and actively manage trading risk.

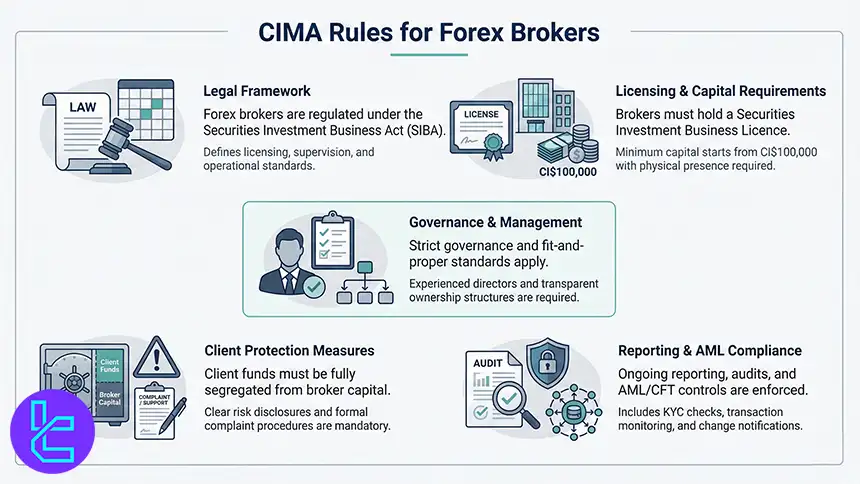

Rules Set by CIMA for Forex Brokers

Forex brokers operating under the oversight of the Cayman Islands Monetary Authority are regulated primarily through the Securities Investment Business Act (SIBA), which defines the legal and supervisory framework for investment firms in the Cayman Islands.

This regime focuses on ensuring financial stability, operational integrity, and baseline client protection rather than imposing highly prescriptive trading restrictions.

To operate legally, brokers must obtain a Securities Investment Business Licence, most commonly under the “Securities - Full” category.

Licensees are required to maintain a registered office with physical substance in the Cayman Islands and meet minimum capital thresholds, starting at CI$100,000, with higher requirements applied depending on business scale and risk profile.

Governance standards are also enforced, including the appointment of experienced directors who meet strict fit-and-proper criteria. From a client protection standpoint, CIMA mandates the segregation of client funds from company operating capital.

Brokers must also implement transparent risk disclosures, particularly for leveraged or complex instruments, and ensure that all marketing communications are clear and not misleading.

Formal complaint-handling procedures are required to address client disputes in a structured and timely manner.

Ongoing supervision is supported through regular reporting and audits. Licensed firms must submit audited annual financial statements, periodic regulatory filings, and compliance certifications.

Any material change in ownership, management, or business activities must be reported to CIMA without delay. In addition, CIMA enforces comprehensive Anti-Money Laundering and Counter-Terrorist Financing standards.

These include strict Know Your Customer procedures and continuous transaction monitoring to identify suspicious activity. Collectively, these rules aim to balance regulatory oversight with the Cayman Islands’ role as an internationally recognized financial center.

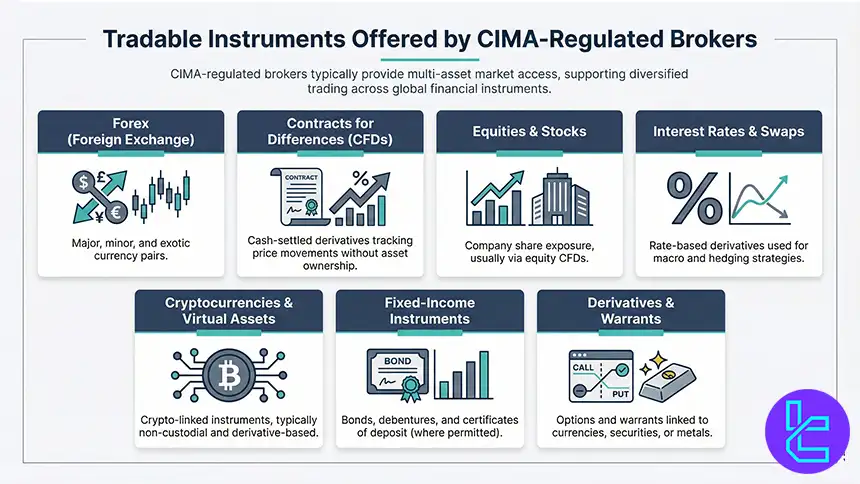

Tradable Instruments in the CIMA Regulated Brokers

Brokers regulated by the Cayman Islands Monetary Authority typically offer access to a wide range of tradable instruments, reflecting the multi-asset and internationally oriented structure of the Cayman Islands financial framework. These instruments allow traders to diversify strategies across currencies, derivatives, and global markets.

The most common asset classes available through CIMA-regulated brokers include:

- Forex (Foreign Exchange): Trading in major, minor, and exotic currency pairs forms the core offering of most brokers, supporting both short-term and long-term FX strategies;

- Contracts for Differences (CFDs): Cash-settled derivatives that provide exposure to price movements without ownership of the underlying asset;

- Equities and Stocks: Exposure to company shares is typically offered via equity CFDs or similar derivative structures rather than direct share ownership;

- Interest Rates and Swaps: Rate-based derivatives linked to movements in benchmark interest rates, used primarily for macro or hedging strategies;

- Virtual Assets and Cryptocurrencies: Digital assets or crypto-linked derivatives may be available, usually structured as non-custodial trading products rather than spot ownership;

- Fixed-Income Instruments: Depending on licensing scope, some brokers provide access to bonds, debentures, loan stock, or certificates of deposit;

- Derivatives and Warrants: Advanced products such as options on currencies, securities, or precious metals, along with warrants that grant conditional subscription rights.

CIMA vs Other Regulatory Bodies

The table below provides a comparison of the CIMA regulation requirements in comparison to other Financial authorities in the world.

Parameter | CIMA (Cayman Islands) | SVGFSA (Saint Vincent and the Grenadines) | MAS (Singapore) | ASIC (Australia) |

Minimum Capital Requirement | CI$100,000 | No | $1 million SGD | Between AU$500,000 and AU$1,000,000 |

Client Fund Segregation | Required | Not Required | Required | Required |

Compensation Scheme | No | No | No | Investor Compensation Fund (AU$10,000) |

Leverage Limits | No limits | No limits | 1:30 | 1:30 |

Negative Balance Protection | Not Mandatory | Not Required | Required | Required |

Reporting & Audits | Not Mandatory | Not Required | Ongoing financial reporting | Ongoing financial reporting |

Conclusion

Based on our review of the best CIMA regulated Forex brokers, we can conclude that Mitrade, Forex.com, Vantage, HYCM, ATC Brokers, and Tradeview Markets are the best available options.

No trades must compare spreads, commissions, transaction methods, leverage, and support quality to choose the best broker based on their trading objectives and risk tolerance.

All brokers have been evaluated based on the factors listed in the TradingFinder Forex Methodology page.