Top Forex brokers with trading APIs provide institutional-grade connectivity through MT4 Expert Advisors (MQL4), FIX API, REST, and proprietary interfaces, enabling sub-millisecond execution, real-time price streaming, and full account control.

Leading providers combine low spreads, deep liquidity, multi-jurisdiction regulation, and high-performance VPS hosting for algorithmic traders. Professional API brokers support automated order routing, historical data access, risk management engines, and third-party platform integration.

| Pepperstone | |||

| AvaTrade | |||

| FP Markets | |||

| 4 |  | FXCM | ||

| 5 |  | Exness | ||

| 6 |  | XM Group | ||

| 7 |  | Vantage | ||

| 8 |  | IC Markets |

Forex Trading API Brokers Rated by Trustpilot

Top Forex trading API brokers show exceptional market credibility, with leading providers achieving Trustpilot scores as high as 4.8/5 across more than 100,000 combined user reviews.

These ratings reflect consistent execution quality, platform stability, API reliability, regulatory strength, and long-term client satisfaction in algorithmic trading environments.

Broker | Trustpilot Rating | Number of Reviews |

IC Markets | 49,951 | |

Exness | 25,861 | |

FP Markets | 9,750 | |

11,517 | ||

FXCM | 818 | |

Vantage Markets | 11,500 | |

3,196 | ||

XM Group | 2,839 |

Trading API Brokers with Lowest Spreads

Top Forex trading API brokers deliver ultra-tight pricing, with multiple providers offering minimum spreads from 0.0 pips or 0.0 points on major currency pairs.

These cost-efficient conditions, combined with high-speed execution, deep liquidity, and API connectivity, significantly enhance performance for high-frequency, algorithmic, and institutional trading strategies.

Broker | Min. Spread |

0.0 Pips | |

FOREX.com | 0.0 pts |

AvaTrade | 0.0 Pips |

Tickmill | 0.0 Pips |

0.0 Pips | |

Pepperstone | 0.0 Pips |

Saxo | 0.4 Pips |

XM Group | 0.6 Pips |

Brokers with Trading APIs Ranked by Non-Trading Fees

Leading Forex trading API brokers minimize operational costs by offering zero deposit and withdrawal fees, with several providers eliminating inactivity charges entirely.

Other brokers apply modest inactivity fees ranging from $10 per month to $50 per year, enabling algorithmic traders to optimize capital efficiency while maintaining full API connectivity and execution performance.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Exness | No | No | No |

IC Markets | No | No | No |

No | Up to 1% | No | |

AvaTrade | No | No | $10/month |

No | No | $10/month | |

FOREX.com | No | No | $15/month |

IG | Up to 1% | No | $18/month |

FXCM | No | Up to $40 | $50/year |

API Trading Brokers’ Trading Instruments

Top Forex trading API brokers provide massive market coverage, with leading platforms offering from over 1,000 to 71,000+ tradable instruments across the Forex market, CFDs, stocks, indices, commodities, ETFs, and bonds.

This depth of product access supports advanced portfolio construction, diversification, and high-performance algorithmic trading strategies.

Broker | Tradable Instruments |

Saxo | 71,000+ |

IG | 17,000+ |

13,000+ | |

FOREX.com | 5,500+ |

IC Markets | 2,200+ |

AvaTrade | 1,250+ |

Pepperstone | 1,200+ |

1,000+ |

Top 6 Brokers with Trading APIs

Best trading API brokers combine tier-1 regulation, deep liquidity, and platform-grade automation for algorithmic execution.

Across this shortlist, minimum deposits range from $1 to $100, leverage reaches up to 1:1000 or higher in eligible regions, and API workflows span MT4/MT5 EAs, TradingView execution, cTrader open API, and FIX connectivity.

AvaTrade

AvaTrade is a globally regulated Forex and CFD broker holding 9 active licenses from major authorities, including CBI, ASIC, FSCA, FSA, CySEC, MiFID, ADGM, BVI FSC, and ISA.

The broker operates under strict compliance standards, offering segregated client funds, negative balance protection, and investor compensation up to €20,000 in eligible jurisdictions.

The broker provides advanced API and automated trading capabilities, primarily through MetaTrader 4 and MetaTrader 5 using MQL programming for Expert Advisors and custom algorithms.

Traders can deploy Python-based strategies, integrate TradingView for direct execution, access APIs for order routing and historical data, and build code-free automation with Capitalise AI, all without additional fees.

Completing the AvaTrade registration process provides access to over 1,250 tradable instruments across Forex, stocks, indices, commodities, cryptocurrencies, bonds, and options.

Traders can use MetaTrader 4, MetaTrader 5, WebTrader, mobile apps, and the AvaOptions platform, with instant order execution and leverage reaching up to 1:400, after completing the AvaTrade verification procedure.

The broker supports multiple account types, including Retail, Professional, Islamic (swap-free), and Demo accounts. The minimum deposit is $100, with funding options via cards, bank wire, PayPal, Skrill, Neteller, and WebMoney. AvaTrade deposit and withdrawal methods are fee-free.

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros and Cons

The following table summarizes the broker’s primary advantages and limitations based on platform infrastructure, regulation, costs, and market access.

Pros | Cons |

Regulated by 9 top-tier global authorities | No U.S. client acceptance |

Over 1,250 tradable instruments across 7 asset classes | Inactivity fees apply after prolonged dormancy |

Supports MT4, MT5, WebTrader, mobile, and AvaOptions | Limited advanced account customization |

No deposit or withdrawal fees | 24/5 support instead of 24/7 |

Vantage

Vantage Markets is a multi-asset broker founded in 2009 and headquartered in Sydney, with a global footprint of 30+ offices. It supports Forex and CFDs across indices, commodities, shares, ETFs, and cryptocurrencies, while maintaining a 4.3/5 Google rating as a quick credibility signal.

The broker operates under a multi-jurisdiction setup with ASIC and FCA as tier-1 regulators, plus FSCA, VFSC, and CIMA oversight. Client safeguards include segregated funds across entities, negative balance protection in most regions, and protection layers such as FSCS up to GBP 85,000 and coverage up to $1,000,000 via Lloyd’s insurance.

Vantage offers enterprise-level API trading solutions for algorithmic and institutional clients.

Traders can connect directly via FIX API for market data and order execution, integrate with MT4/MT5 bridge technology, and deploy custom trading systems. Connectivity is powered by partners such as OneZero and PrimeXM/XCore, delivering ultra-low latency, complex order routing, and real-time risk management.

Entry barriers remain low, with a $20 minimum deposit, 0.01 lot minimum order size, and leverage up to 1:1000 for eligible jurisdictions, all available after completing the Vantage Markets registration process.

The account lineup includes Standard STP, Standard Cent, Raw ECN, Pro ECN, and Swap Free, plus passive options via ZuluTrade, DupliTrade, and Myfxbook AutoTrade.

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Regulating Authorities | ASIC, FSCA, VFSC, FCA, CIMA |

Minimum Deposit | $20 |

Deposit Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Withdrawal Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, ProTrader, TradingView, proprietary application |

Vantage Pros and Cons

The following table outlines Vantage Markets’ main advantages and drawbacks, summarizing how its regulatory strength, API technology, pricing model, and global access translate into real-world trading performance.

Pros | Cons |

Institutional-grade FIX API with ultra-low latency connectivity | Restricted access in some countries, including US and Canada |

Tier-1 regulation via ASIC and FCA | High minimum deposit for Pro ECN account |

Wide platform selection, including TradingView, MT4, and MT5 | No full proprietary desktop trading terminal |

No inactivity fees and a strong non-trading fee profile | Negative balance protection not uniform across all entities |

FXCM

FXCM, short for Forex Capital Markets, has operated in the global Forex and CFD industry since 1999, making it one of the longest-established brokers in the market. The company holds licenses from FCA, ASIC, CySEC, FSCA, and ISA, maintaining a multi-jurisdiction regulatory structure with strict capital and client-protection requirements.

FXCM provides a robust suite of free API services that connect directly to its trading servers, enabling automated trading, custom platform development, and real-time data access.

Available APIs include the high-performance FIX API, Java API, and the proprietary ForexConnect SDK, each designed to support different trading and development requirements.

The FIX API delivers institutional-grade performance with up to 250 price updates per second and full order-type support, while the Java API offers a lightweight, cross-platform wrapper for scalable strategy deployment.

FXCM ForexConnect extends Trading Station functionality across Python, C++, C#, Java, and .NET, supporting automated systems, historical data access, and advanced trade management.

FXCM registration provides access to three primary account structures, including CFD, Active Trader, and Corporate accounts.

Account Types | CFD account, Active Trader account, Corporate account |

Regulating Authorities | FCA, ASIC, CySEC, ISA, FSCA |

Minimum Deposit | $50 |

Deposit Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Withdrawal Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, TradingView, TradeStation |

FXCM Pros and Cons

The table below summarizes FXCM’s main advantages and drawbacks, reflecting how its long operating history, regulatory standing, and automation framework translate into real-world trading conditions.

Pros | Cons |

Over 20 years of industry experience with multi-tier regulation | Past regulatory penalties and corporate restructuring history |

Strong automated trading and API framework via MT4, TradingView, TradeStation, and Capitalise AI | $50 annual inactivity fee |

High client fund protection, including FSCS and ICF coverage | $40 fee on bank wire withdrawals |

FXCM rebate program with cashbacks of up to $2 for gold trading | Restricted access in several jurisdictions, including the US |

FP Markets

FP Markets, also known as First Prudential Markets, is an Australian broker established in 2005 with multi-jurisdiction oversight from ASIC and CySEC, alongside FSCA, FSC, and offshore FSA entities. This regulatory mix supports segregated client funds, negative balance protection, and structured compliance across key regions.

FP Markets supports API style automation mainly through platform-based algorithmic trading. Traders can deploy MetaTrader 4 and MetaTrader 5 Expert Advisors using MQL, run systematic strategies on cTrader, and manage execution with low-latency infrastructure typical of ECN environments. Automation aligns with floating pricing and rapid order handling.

The broker offers two core account types, Standard and RAW, with a $50 minimum deposit and 0.01 lot minimum order size, all available after completing the FP Markets registration process.

RAW pricing starts from 0.0 pips with a $3 commission per lot, while Standard accounts typically price from 1.0 pips with no added commission, depending on the instrument. Note that to fully access the broker’s services, traders must go through the FP Markets verification procedure.

FP Markets provides broad market access across Forex, CFDs, ETFs, indices, commodities, metals, cryptocurrencies, and stocks, with a product list exceeding 10,000 instruments.

Leverage depends on jurisdiction and account classification, while risk controls include a 100% margin call and a 50% stop-out framework for leveraged portfolios. FP Markets deposit and withdrawal methods include cards, Skrill, Neteller, etc.

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Deposit | $50 |

Deposit Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Withdrawal Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader |

FP Markets Pros and Cons

The next table highlights FP Markets pros and cons that are expanded in the following sections, focusing on regulation depth, platform variety, pricing model, and client eligibility limitations.

Pros | Cons |

Multi-regulated structure with ASIC and CySEC oversight | No proprietary trading platform |

RAW spreads from 0.0 pips with a transparent $3 commission model | Not available to US clients |

Strong platform lineup: MT4, MT5, and cTrader | Investor compensation depends on the entity and jurisdiction |

10,000+ instruments across multi-asset markets | Offshore entities offer higher leverage but a lower regulatory tier |

Pepperstone

Pepperstone is a global Forex and CFD broker founded in 2010 in Melbourne, now serving 400,000+ clients and processing an average daily trading volume of $9.2B. It supports 10 base currencies, including AUD, USD, GBP, JPY, and EUR, with position sizing from 0.01 to 100 lots.

The broker operates under a broad regulatory framework led by top-tier authorities such as AbSIC, FCA, CySEC, and BaFin, alongside DFSA and Kenya’s CMA, leading to a comprehensive Pepperstone registration process.

Pepperstone supports API driven and automated trading primarily through platform connectivity and algorithmic toolsets. Traders can run Expert Advisors on MT4 and MT5 via MQL, use cTrader Automate with C# and open API capabilities, and connect TradingView for streamlined execution inside a charting-driven workflow.

Trading conditions are built for active strategies, with spreads from 0.0 pips, leverage up to 1:500 in eligible jurisdictions, and two core account types: Standard and Razor.

The broker also offers a proprietary platform, instant execution, Pepperstone rebate program with commission cashbacks of up to 12.857%, and a 90% margin call with a 20% stop out threshold on supported entities.

Account Types | Standard, Razor |

Regulating Authorities | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Deposit | $1 |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Pepperstone Pros and Cons

The table below summarizes Pepperstone’s main strengths and limitations, setting the stage for the detailed pros and cons list that follows across regulation, platforms, pricing, and investment features.

Pros | Cons |

High-tier regulation across ASIC, FCA, CySEC, and BaFin | Limited promotional offerings due to regulatory constraints |

Strong API and automation stack via MT4, MT5, cTrader open API, and TradingView | No PAMM account structure for managed investing |

Tight pricing with spreads from 0.0 pips and Razor commission model | Access restrictions in several countries, including the US and Canada |

No account keeping or inactivity fees, and broad funding options | Demo availability can be limited by region or onboarding rules |

Exness

Exness is a global Forex broker founded in 2008 by Petr Valov and Igor Lychagov, backed by a 2,100+ person team spanning almost 100 countries. Monthly trading volume exceeds $4 trillion, positioning Exness among the largest retail focused brokers by activity and liquidity flow.

The broker operates through multiple regulated entities under FCA and CySEC as tier-1 supervisors, alongside FSCA, CMA, FSC BVI, FSA, and CBCS oversight.

By completing the Exness registration process, traders benefit from client safeguards, including segregated funds, negative balance protection, and compensation coverage up to £85,000 under FSCS and up to €20,000 under ICF.

Exness supports API style automation mainly through its MetaTrader ecosystem and proprietary terminals. Traders can run Expert Advisors on MT4 and MT5 using MQL, connect systematic workflows through the Exness Terminal web platform, and use Exness VPS to reduce latency for algorithmic execution, order management, and data-driven strategy monitoring.

Exness dashboard provides account access starting from a $10 minimum deposit, with a 0.01 lot minimum order size and spreads ranging from 0.0 to 0.8 pips depending on account type.

Commission pricing runs from $0.2 up to $3.5, while execution combines market and instant models, with stop out set at 0% across key setups. The Exness rebate program offers forex cashbacks of up to $112.5 per lot.

Account Types | Standard, Standard Cent, pro, Raw Spread, Zero |

Regulating Authorities | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Deposit | $10 |

Deposit Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Withdrawal Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Maximum Leverage | Unlimited |

Trading Platforms & Apps | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Exness Pros and Cons

The following table summarizes Exness' strengths and limitations, preparing the ground for the detailed pros and cons list that follows across regulation, pricing, automation support, and instrument availability.

Pros | Cons |

Extremely high trading activity with $4T+ monthly volume | Limited educational depth compared to top learning hubs |

Tight pricing with spreads from 0.0 pips and commissions from $0.2 | Product availability varies by account type and region |

Strong protection stack with segregated funds and negative balance protection | Restricted in multiple countries due to compliance rules |

Solid automation environment via MT4, MT5, and Exness VPS | No PAMM structure for managed account investing |

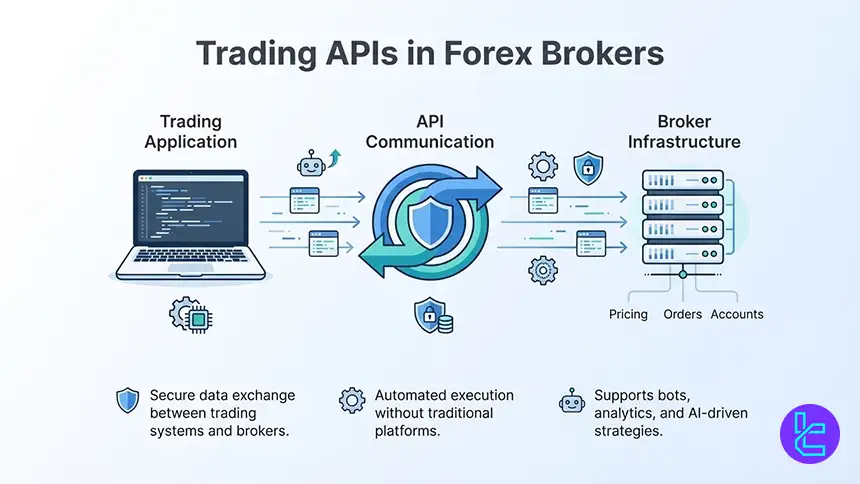

What Are APIs?

Application Programming Interfaces, commonly known as APIs, enable two software systems to communicate securely and exchange data. In Forex trading, APIs connect proprietary trading tools, analytics engines, and automated systems directly to broker infrastructure, including pricing engines, order routers, and account management systems.

For API traders, the traditional trading platform becomes optional. Instead of relying on browser or desktop terminals, traders execute strategies through code-driven environments.

This approach supports advanced automation, custom analytics, and integration with artificial intelligence or machine learning models used in modern trading operations.

- Enable structured data exchange between applications and brokers;

- Support automation beyond standard trading platforms;

- Power proprietary tools, bots, and analytics engines;

- Reduce manual interaction with broker interfaces.

What is a Trading API?

A trading API is a specialized interface that allows programmatic interaction with a brokerage account. It supports functions such as sending and canceling orders, retrieving live prices, downloading historical data, and monitoring balances, margin, and open positions without manual platform interaction.

Trading APIs replace or complement standard platforms depending on the setup. While MT4 and MT5 automation still requires the platform to run, proprietary APIs based on FIX, REST, or WebSocket protocols allow traders to bypass traditional interfaces entirely and operate through custom software environments.

Benefits of Trading via APIs

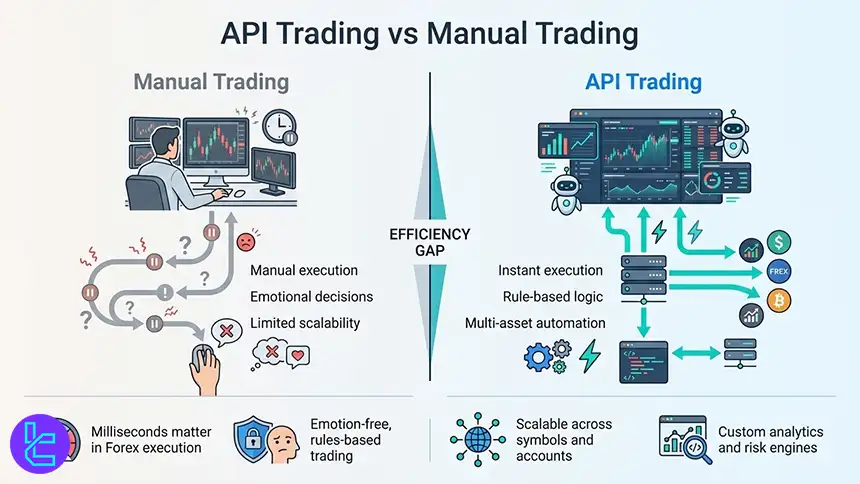

Trading via APIs increases execution speed, consistency, and scalability. Automated systems react instantly to market conditions, removing emotional bias and manual delays. This advantage is critical in fast-moving Forex markets where milliseconds can influence fill quality and slippage.

APIs also unlock full customization. Traders can design dashboards, risk engines, and signal processors tailored to their trading strategies. Portfolio level automation across multiple symbols and accounts becomes feasible, supporting professional-grade trading workflows used by funds and high-volume traders.

- Faster execution and reduced latency

- Consistent rule-based trading without emotion

- Custom tools, alerts, and analytics

- Scalable strategies across assets and accounts

Is API Trading allowed on Brokers?

API trading is widely allowed, especially among brokers that support algorithmic trading or Expert Advisors on MetaTrader platforms. Many brokers do not advertise APIs directly, yet still permit automation through MT4 or MT5 plugins without special approval.

Access to proprietary APIs may involve conditions such as minimum deposits, trading volume thresholds, or institutional onboarding. Brokers also impose rate limits and acceptable use policies to maintain fair execution and infrastructure stability across automated trading clients.

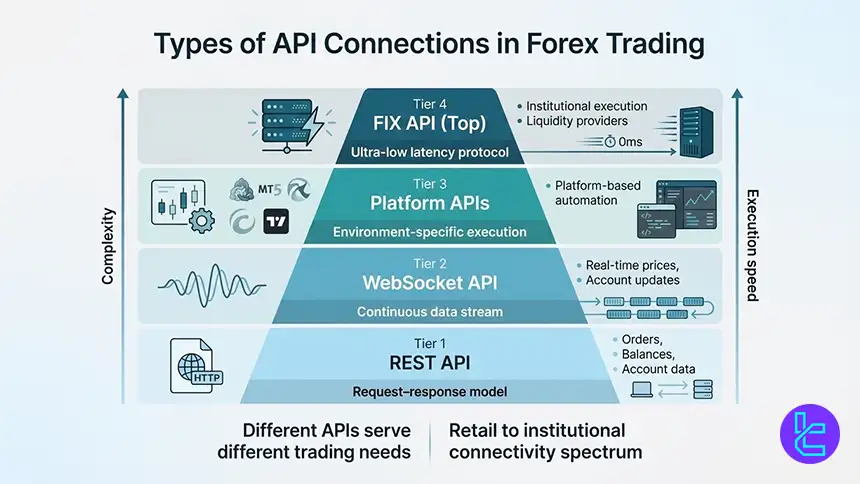

What Are the Various Types of API Connections?

Forex brokers offer multiple API connection types designed for different trading needs. REST APIs handle request-response operations like placing trades or fetching balances. WebSocket APIs stream real-time prices and account updates continuously with low latency.

Institutional traders often rely on FIX APIs, a standardized protocol used by banks and liquidity providers for high-speed execution. Platform-specific APIs, such as MT4, MT5, cTrader, and TradingView integrations, offer automation tied to popular trading environments.

- REST APIs for orders and account data

- WebSocket APIs for live streaming data

- FIX APIs for institutional low latency trading

- Platform APIs for MT4, MT5, cTrader, and TradingView

How to Connect a Forex API to a Broker

Connecting a Forex API starts with selecting a broker and reviewing its API documentation. Traders then request credentials such as API keys or tokens, which authenticate their software and define permitted actions. Integration requires coding the supported commands and handling responses securely.

Before live deployment, testing is essential. Brokers typically provide demo or UAT environments to validate order flow, error handling, and latency behavior. Some FIX connections require conformance testing to ensure protocol compliance and system stability under live conditions.

- Develop or prepare a custom trading application;

- Request and configure API credentials;

- Integrate endpoints and authentication;

- Test extensively in demo or UAT environments.

Is API Trading Free?

API access itself can be free, especially for MT4 and MT5 automation, where no special permission is required. Many brokers also provide proprietary APIs at no direct cost once eligibility requirements are met, such as minimum deposits or trading volumes.

However, total costs extend beyond access. Development time, VPS hosting, data subscriptions, and ongoing maintenance contribute significantly. Trading costs like spreads, commissions, and slippage remain the primary determinants of long-term profitability in API driven strategies.

- MT4 and MT5 APIs are typically free;

- Proprietary APIs may have eligibility conditions;

- Infrastructure and development costs apply;

- Trading fees still impact performance.

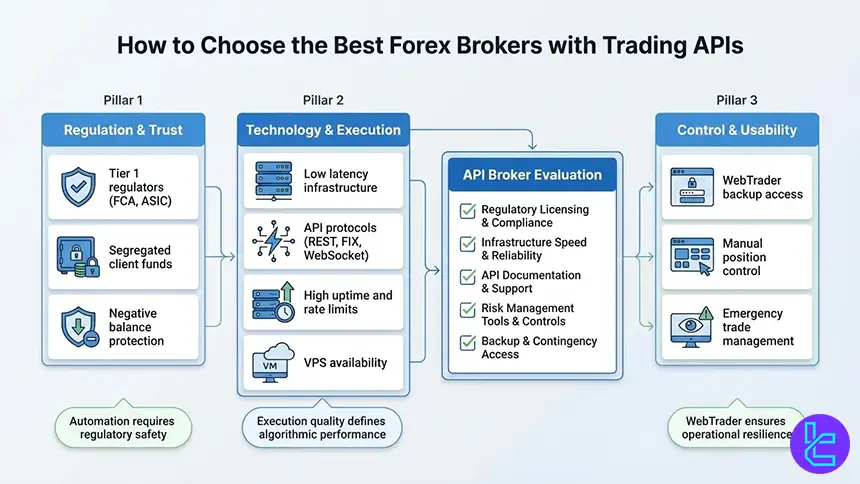

How to Choose the Best Forex Brokers with Trading APIs

Selecting the best API broker requires balancing regulation, execution quality, and technical reliability. Tier 1 regulators such as FCA and ASIC provide strong client protection frameworks, while segregated funds and negative balance protection reduce operational risk for automated trading.

From a technical perspective, traders should evaluate supported protocols, documentation quality, uptime history, rate limits, and VPS availability. WebTrader access remains valuable for manual oversight, emergency position management, and monitoring when automated systems encounter issues.

- Strong regulation and client protection

- Reliable execution and low latency infrastructure

- Clear API documentation and testing environments

- WebTrader availability for backup control

What is Algorithmic Trading?

Algorithmic trading uses coded rules to automate decision-making in financial markets. Strategies define when to enter or exit trades, how to size positions, and how to manage risk. Once deployed, the algorithm executes these rules automatically without manual intervention.

Even simple algorithms can enhance discipline and consistency. Advanced systems incorporate statistical models, volatility filters, and multi-asset correlations. Modern Forex markets rely heavily on algorithmic activity, with automated trading accounting for over 80% of daily volume.

How to Create an API Key

Creating an API key usually occurs within a broker’s client portal or developer dashboard. Traders enable API access, generate a key and secret, and assign permissions such as data access or trade execution. These credentials authenticate all API requests.

Security is critical. API keys should be stored securely, rotated periodically, and restricted by IP address when possible. Testing should begin with limited permissions in a demo environment to reduce risk before live trading deployment.

- Generate keys in broker or developer portal;

- Assign scopes and permissions carefully;

- Store secrets securely and rotate regularly;

- Test with minimal access in demo mode.

Are There Any Downsides to Using Trading APIs?

Trading APIs introduce a powerful layer of automation and flexibility, but they also increase technical complexity. Unlike standard trading platforms, API-based setups require coding knowledge, infrastructure planning, and continuous monitoring.

Strategy errors, logic flaws, or integration mistakes can directly impact execution quality and account performance.

Operational risks are another key consideration. API trading depends on stable servers, low-latency connectivity, and uninterrupted broker infrastructure.

Network failures, API downtime, rate limits, or data feed disruptions can lead to missed executions, partial fills, or unmanaged exposure, particularly during high-volatility market conditions.

Key Downsides of Trading APIs

- Higher entry barrier due to programming and system design requirements

- Ongoing development, testing, and maintenance costs

- Increased exposure to technical failures and connectivity issues

- Security risks if API keys or servers are poorly protected

- Broker restrictions such as rate limits, volume thresholds, or access conditions

- Greater responsibility for risk controls and error handling

Is Forex Trading API Only for Experienced Traders?

Forex trading APIs are not exclusively designed for advanced or institutional traders. While experienced developers often benefit most, many brokers now offer visual strategy builders, prebuilt automation templates, and sandbox environments.

These tools reduce technical barriers and allow less experienced traders to experiment with API-based execution safely.

Modern API ecosystems increasingly support gradual learning. Beginners can start with rule-based automation, connect APIs to familiar platforms, or use no-code and low-code solutions before progressing to full algorithmic systems. Demo environments and extensive documentation further lower the entry threshold for retail-level users.

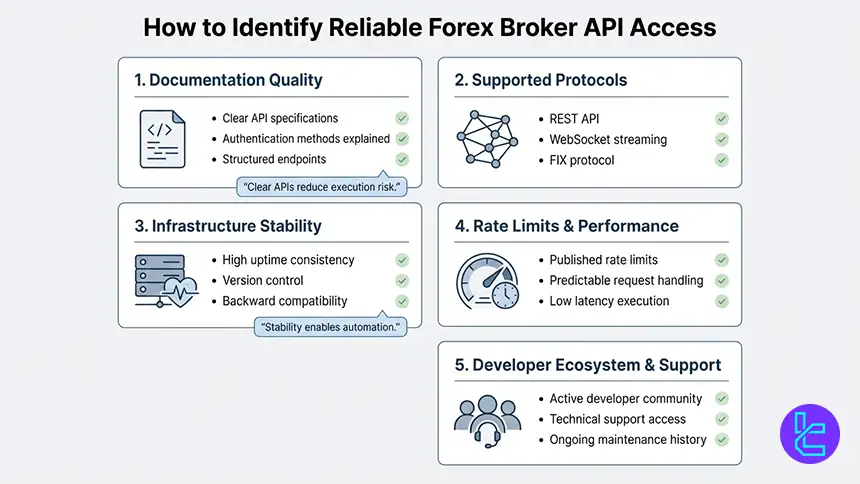

How Do I Know Whether a Forex Broker Gives Reliable API Access?

Reliable API access depends on transparency, stability, and technical depth. Brokers with well-documented APIs, clear authentication methods, and structured endpoints for orders, pricing, and account data signal higher reliability. Support for widely adopted standards like REST, WebSocket, or FIX also indicates mature infrastructure.

Operational reliability is equally important. Brokers with consistent uptime records, published rate limits, version control, and active developer communities provide safer environments for automation.

Long-term API stability, backward compatibility, and responsive technical support are essential for maintaining uninterrupted algorithmic trading systems.

- Comprehensive and up-to-date API documentation

- Support for REST, WebSocket, or FIX protocols

- Stable uptime and clearly defined rate limits

- Active developer community and support channels

- Proven history of API reliability and maintenance

Comparison Table of Various API Protocols

Trading API protocols form the technical backbone of automated and algorithmic trading, defining how trading systems communicate with broker infrastructure for data access and order execution.

Each protocol differs in latency, complexity, and functionality, making the choice of API a critical factor for execution quality, scalability, and overall trading performance.

API Protocol | Latency & Speed | Complexity Level | Typical Use Cases | Real-Time Data Support | Best Suited For |

FIX (Financial Information eXchange) | Very low latency | High | Institutional trading, HFT, direct market access, liquidity aggregation | Yes | Professional traders, prop firms, banks |

REST | Medium latency | Low to medium | Order placement, account management, historical data requests | Limited (polling based) | Retail traders, developers, automation beginners |

WebSocket | Low latency | Medium | Live price streaming, real-time order updates, fast execution feedback | Yes | Algorithmic traders, real-time systems |

MT4 / MT5 (MQL, DLL based) | Medium latency | Medium | Expert Advisors, retail automation, indicator based strategies | Yes (platform dependent) | Retail and semi-advanced traders |

TradingView | Medium latency | Low to medium | Charting, signal generation, alert based execution | Limited (execution via broker bridge) | Strategy designers, technical analysts |

Java | Low to medium latency | Medium | Custom trading applications, enterprise systems | Yes | Software engineers, institutional setups |

.NET | Low to medium latency | Medium | Desktop trading tools, Windows based systems | Yes | Developers using C# and .NET stack |

Streaming Market Data | Very low latency | Medium | Tick data feeds, order book monitoring, analytics engines | Yes | Quant traders, data driven strategies |

Broker Proprietary API | Varies by broker | Medium to high | Custom broker features, internal execution logic | Yes | Broker specific system users |

Conclusion and Final Words

Brokers offering MT4 and MT5 automation, REST, WebSocket, or FIX APIs enable algorithmic traders to achieve low latency execution, real-time data access, and scalable strategy deployment across multiple asset classes

Top API trading brokers typically combine tight spreads from 0.0 pips, deep liquidity, and strong regulatory oversight under authorities such as FCA, ASIC, and CySEC. High Trustpilot ratings, broad instrument coverage, and minimal non-trading fees further reflect operational stability and long-term suitability.

The final broker rankings are derived using the TradingFinder Forex Methodology, a multi-factor evaluation framework that assesses regulation, execution quality, API infrastructure, cost efficiency, platform support, and user trust metrics.