Malaysia’s Forex market operates under the supervision of the Securities Commission Malaysia (SCM), providing a structured framework for investor protection and broker oversight.

Traders typically access global markets through international brokers that comply with strict regulatory and operational standards. Key evaluation factors include regulation, trading costs, execution quality, and platform availability.

| FXCM | |||

| AvaTrade | |||

| FxPro | |||

| 4 |  | BlackBull Markets | ||

| 5 |  | Vantage Markets | ||

| 6 |  | HYCM | ||

| 7 |  | HF Markets | ||

| 8 |  | ActivTrades | ||

| 9 |  | FBS | ||

| 10 |  | EasyMarkets |

Comparison of Malaysian Forex Brokers Based on Trustpilot Rating

Trustpilot ratings provide an external, user driven perspective on the real trading experience offered by Forex brokers accessible to Malaysian traders.

Broker | Trustpilot Rating | Number of Reviews |

FXCM | 4.0/5⭐️ | 815 |

AvaTrade | 4.0/5⭐️ | 11478 |

3.8/5⭐️ | 862 | |

BlackBull Markets | 4.8/5⭐️ | 2915 |

Vantage Markets | 4.5/5 ⭐️ | 11380 |

HYCM | 2.0/5 ⭐️ | 161 |

HF Markets | 4.6/5 ⭐️ | 2950 |

ActivTrades | 3.9/5 ⭐️ | 1250 |

4.3/5 ⭐️ | 8000 | |

4.2/5 ⭐️ | 1770 |

Malaysian Forex Brokers Comparison Based on Spreads

Brokers operating in or accessible from Malaysia typically offer variable spreads influenced by liquidity providers, account type, and market volatility.

While tight spreads improve cost efficiency, they should be evaluated alongside execution quality, commissions, and regulatory oversight by the Securities Commission Malaysia.

Broker | Min. Spread |

BlackBull Markets | 0.0 pips |

Vantage Markets | 0.0 pips |

Tickmill | 0.0 pips |

| Eightcap | 0.0 pips |

HYCM | 0.1 pips |

0.2 pips | |

ActivTrades | 0.5 pips |

XM Group | 0.6 Pips |

FBS | 0.7 pips |

| Ava Trade | Depending on the Asset |

Non-Trading Fees in Malaysian Forex Brokers

Non-trading fees represent indirect costs that can impact long-term profitability for Malaysian Forex traders, even when no active positions are open.

While some brokers accessible in Malaysia offer zero-fee funding options, others apply charges depending on the payment method or inactivity period.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

FXCM | $0 | $0 | Yes |

AvaTrade | $0 | $0 | Yes |

$0 | $0 | Yes | |

$0 | $0 | No | |

Vantage Markets | $0 | $0 | No |

HYCM | $0 | $0 | Yes |

FBS | $0 | $0 | No |

Tickmill | $0 | $0 | Yes |

Eightcap | $0 | $0 | Yes |

XM Group | $0 | $0 | Yes |

Tradabale Instruments of Forex Brokers in Malaysia

Alongside major, minor, and selected exotic Forex pairs, many platforms also offer CFDs on indices, commodities, metals, cryptocurrencies, and global equities.

The availability of these instruments often depends on the broker’s regulatory structure and cross-border licensing, especially for brokers operating in alignment with the Securities Commission Malaysia framework.

Broker | Number of Instruments |

BlackBull Markets | 26K+ |

FXCM | 3000+ |

FxPro | 2100+ |

XM Group | 1400+ |

AvaTrade | 1250+ |

1000+ | |

1000+ | |

Eightcap | 800+ |

Tickmill | 600+ |

300+ |

Top 10 Forex Brokers in Malaysia

The top Forex brokers available to Malaysian traders are selected based on regulatory credibility, trading costs, platform quality, and overall trust metrics.

Since Malaysia’s domestic Forex activity is overseen by the Securities Commission Malaysia, most reputable brokers operate through international licenses while remaining accessible to Malaysian residents.

FXCM

FXCM, short for Forex Capital Markets, is a globally recognized forex and CFD broker founded in 1999 with more than two decades of industry experience.

The broker operates under a multi-regulatory framework, holding licenses from top-tier authorities such as the FCA, ASIC, CySEC, FSCA, and ISA, which enhances its credibility and investor protection standards.

The broker provides trading across major asset classes such as forex, indices, commodities, cryptocurrencies, and share CFDs, with floating spreads starting from 0.2 pips and commission-free trading on most instruments (FXCM rebate is also available).

After FXCM registration, client funds are protected through segregated accounts and negative balance protection, while eligible clients may benefit from compensation schemes depending on jurisdiction.

Although FXCM faced regulatory challenges in the past, it has maintained a strong international presence and continues to serve traders seeking regulated market access, advanced platforms, and diverse trading tools.

Account Types | CFD, Active Trader, Corporate |

Regulating Authorities | FCA, ASIC, CySEC, FSCA, ISA |

Minimum Deposit | $50 |

Deposit Methods | Credit/Debit Cards, Bank Wire, Skrill, Neteller |

Withdrawal Methods | Credit/Debit Cards, Bank Wire, Skrill, Neteller |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4, TradingView, TradeStation |

FXCM Pros and Cons

Table below, highlights the FXCM brokers pros and cons at a glance:

Pros | Cons |

Regulated by multiple tier-1 authorities (FCA, ASIC, CySEC) | History of regulatory penalties and past bankruptcy |

Access to TradingView, MT4, and TradeStation | Bank wire withdrawals carry a $40 fee |

Competitive spreads from 0.2 pips | Annual inactivity fee applies |

Negative balance protection available | Limited availability in some countries |

Suitable for algorithmic and active traders | No PAMM account support |

AvaTrade

AvaTrade is a globally established Forex and CFD broker founded in 2006, serving traders in more than 150 countries.

The broker operates under a strong multi regulatory framework, holding licenses from top tier authorities such as the Central Bank of Ireland (CBI), ASIC, FSCA, FSA Japan, ADGM, and CySEC, which significantly enhances its credibility and client protection standards.

In AvaTrade dashboard, trading is supported via multiple platforms such as MetaTrader 4, MetaTrader 5, WebTrader, and the proprietary AvaTrade mobile app, making it suitable for both beginners and experienced traders.

The broker offers fixed and competitive spreads, commission free trading, AvaTrade rebate, Islamic accounts, and copy trading solutions through AvaSocial and DupliTrade.

With segregated client funds, negative balance protection, and strong educational resources, the broker stands out as a secure and user friendly trading environment with easy AvaTrade registration.

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | CBI, ASIC, CySEC, FSCA, FSA, ADGM |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, Bank Wire, Skrill, Neteller, WebMoney, PayPal |

Withdrawal Methods | Credit/Debit Cards, Bank Wire, Skrill, Neteller, PayPal |

Maximum Leverage | Up to 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, WebTrader, Mobile App |

AvaTrade Pros and Cons

The table below provides a quick overview of AvaTrade broker strengths and weaknesses.

Parameter | Details |

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | CBI, ASIC, CySEC, FSCA, FSA, ADGM |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, Bank Wire, Skrill, Neteller, WebMoney, PayPal |

Withdrawal Methods | Credit/Debit Cards, Bank Wire, Skrill, Neteller, PayPal |

Maximum Leverage | Up to 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, WebTrader, Mobile App |

FxPro

FxPro is a globally established Forex and CFD broker founded in 2006, with more than 15 years of operational history and over 7.8 million registered client accounts worldwide.

The broker is known for its fast execution speed, processing trades in under 12 milliseconds, and for offering access to more than 2,100 tradable instruments across multiple asset classes.

FxPro operates under a multi regulated structure, holding licenses from top tier authorities such as the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), and the Securities Commission of The Bahamas (SCB).

FxPro dashboard supports several advanced trading platforms including MetaTrader 4, MetaTrader 5, cTrader, WebTrader, and a proprietary mobile app.

With multiple account types, copy trading services, Islamic accounts, FxPro rebate and competitive spreads starting from 0.0 pips, FxPro is suitable for both retail and professional traders seeking a regulated and technology driven trading environment.

Account Types | Standard, Raw+, Elite |

Regulating Authorities | FCA, CySEC, FSCA, SCB |

Minimum Deposit | $100 |

Deposit Methods | Visa, Mastercard, Bank Wire, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, Mastercard, Bank Wire, Skrill, Neteller, PayPal |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader, WebTrader, Mobile App |

FxPro Pros and Cons

The following table presents FxPro’s main advantages and disadvantages in a concise format.

Pros | Cons |

Regulated by multiple tier 1 authorities | Not available for U.S. and Canadian clients |

Access to 2,100+ trading instruments | Limited bonus and promotional offers |

MT4, MT5, cTrader, WebTrader support | No 24/7 customer support |

Fast execution and deep liquidity | Higher minimum deposit for Elite account |

Copy trading and Islamic account availability | Some country based restrictions |

BlackBull Markets

BlackBull Markets is a New Zealand based Forex and CFD broker founded in 2014, operating under the legal entity Black Bull Group Limited.

The broker is regulated by the Financial Markets Authority (FMA) in New Zealand and the Financial Services Authority (FSA) in Seychelles, offering a combination of tier 1 and offshore regulatory coverage.

BlackBull Markets provides access to more than 26,000 tradable instruments across Forex, indices, commodities, metals, cryptocurrencies, and share CFDs.

Trading is executed through an ECN environment with ultra-fast execution, deep liquidity, and spreads starting from 0.0 pips on ECN accounts.

With no minimum deposit on its Standard account, leverage up to 1:500, 24/7 customer support, and strong trust scores on Trustpilot, BlackBull Markets registration is well suited for active traders, scalpers, and professional investors.

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | FMA (New Zealand), FSA (Seychelles) |

Minimum Deposit | $0 (ECN Standard) |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Skrill, Neteller, SEPA |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Skrill, Neteller, SEPA |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader, TradingView, BlackBull CopyTrader, BlackBull Invest |

BlackBull Markets Pros and Cons

Below is a table summarizing the key pros and cons of the BlackBull Markets brokerage.

Pros | Cons |

Regulated by FMA New Zealand and FSA Seychelles | Limited availability in some regions |

ECN trading with spreads from 0.0 pips | ECN Prime requires a $2,000 minimum deposit |

Access to 26,000+ tradable instruments | Wide product range may overwhelm beginners |

Supports MT4, MT5, cTrader, and TradingView | No U.S. clients accepted |

24/7 customer support and strong Trustpilot rating | Withdrawal fee of $5 per transaction |

Vantage Markets

Vantage Markets is a global Forex and CFD broker founded in 2009 and headquartered in Sydney, Australia, with more than 30 offices worldwide.

The broker offers access to a broad range of markets including Forex, indices, commodities, shares, ETFs, and cryptocurrencies, with spreads starting from 0.0 pips on ECN accounts.

Vantage operates under a strong multi-regulatory framework, holding licenses from tier-1 authorities such as the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA), alongside FSCA, VFSC, and CIMA.

After Vantage Markets registration, client funds are kept in segregated accounts, and negative balance protection is available for most entities.

With copy trading via ZuluTrade, DupliTrade, and Myfxbook AutoTrade, low minimum deposit requirements, and 24/7 support, Vantage Markets suits both beginner and professional traders.

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Regulating Authorities | ASIC, FCA, FSCA, VFSC, CIMA |

Minimum Deposit | $20 |

Deposit Methods | Credit/Debit Cards, Bank Transfer, Skrill, Neteller, PayPal, Perfect Money, Local Methods |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer, Skrill, Neteller, PayPal, Local Methods |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, ProTrader, TradingView, Mobile App |

Vantage Markets Pros and Cons

The table shown here outlines Vantage Markets’s positive features and limitations clearly.

Pros | Cons |

Regulated by multiple tier-1 authorities | High minimum deposit on Pro ECN account |

Spreads from 0.0 pips on ECN accounts | No proprietary desktop platform |

MT4, MT5, ProTrader, TradingView support | Restricted in some countries (e.g. US, Canada) |

Copy trading and social trading available | Trustpilot score lower than some competitors |

Low minimum deposit from $20 | Bonuses not available in all regions |

HYCM

HYCM is a long-established multi-regulated Forex and CFD broker operating under top-tier authorities such as the Financial Conduct Authority (UK) and the Dubai Financial Services Authority (UAE), with additional international coverage.

HYCM dashboard offers three main account types Fixed, Classic, and RAW with a low minimum deposit of $20, making it accessible to beginners while still suitable for high-volume traders.

HYCM supports a broad range of markets including Forex, indices, commodities, stocks, metals, energy, and cryptocurrencies, available via MetaTrader 4, MetaTrader 5, and its proprietary HYCM Trader app.

With spreads starting from 0.1 pips on RAW accounts, flexible leverage up to 1:500 for non-UK clients (available after HYCM verification), and multiple HYCM deposit and withdrawal methods including crypto, HYCM positions itself as a competitive, regulation-focused broker for global traders.

Account Types | Fixed, Classic, RAW, Demo, Islamic |

Regulating Authorities | Financial Conduct Authority, Dubai Financial Services Authority, CIMA |

Minimum Deposit | $20 |

Deposit Methods | Bank Wire, Credit/Debit Cards, Skrill, Neteller, Crypto |

Withdrawal Methods | Bank Wire, Credit/Debit Cards, Skrill, Neteller, Crypto |

Maximum Leverage | Up to 1:500 (varies by regulation) |

Trading Platforms & Apps | MT4, MT5, HYCM Trader |

HYCM Pros and Cons

In the table below, HYCM’s benefits and drawbacks are displayed for fast comparison.

Pros | Cons |

Regulated by FCA and DFSA with segregated client funds | EU clients no longer accepted |

Low minimum deposit starting from $20 | Limited educational materials |

Competitive RAW spreads from 0.1 pips | $10 monthly inactivity fee |

Supports MT4, MT5, and proprietary mobile app | No dedicated social trading platform |

Wide range of tradable instruments | Trustpilot rating is moderate |

Islamic and demo accounts available | Some country restrictions apply |

HF Markets

HFM, also known as HF Markets, is a globally recognized multi-asset broker established in 2010, serving over 2.5 million live accounts across 180+ countries.

The broker operates under multiple regulatory bodies, including CySEC, FCA, DFSA, and FSCA, ensuring a strong compliance framework.

In HFM dashboard, Traders can choose from several account types, including Cent, Zero, Pro, and Premium, with spreads starting from 0.0 pips on Zero accounts and leverage reaching up to 1:2000 under offshore entities.

The broker supports MetaTrader 4, MetaTrader 5, and a proprietary mobile app, alongside HFM copy trading and PAMM solutions. With negative balance protection, segregated client funds, HYCM rebate and a Trustpilot score of 4.6 out of 5, HFM positions itself as a competitive choice for both beginner and advanced traders.

Account Types | Cent, Zero, Pro, Premium |

Regulating Authorities | CySEC, FCA, DFSA, FSCA, FSA |

Minimum Deposit | From $0 |

Deposit Methods | Bank wire, credit/debit cards, e-payments, crypto |

Withdrawal Methods | Bank wire, cards, e-payments, crypto |

Maximum Leverage | Up to 1:2000 (offshore entities) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App |

HFM Pros and Cons

The next table offers a brief snapshot of HFM broker advantages and shortcomings.

Pros | Cons |

Regulated by multiple tier-1 and tier-2 authorities | Restricted in several countries including the US |

Wide range of tradable instruments (1,000+) | Platform choice limited mainly to MT4 and MT5 |

Multiple account types with low minimum deposit | Mixed feedback on customer support quality |

High leverage options for non-EU clients | Occasional technical issues reported |

Copy trading and PAMM investment solutions | Bonuses not available under EU regulation |

ActivTrades

ActivTrades is a London-based Forex and CFD broker founded in 2001, serving traders from more than 170 countries worldwide.

The broker is primarily regulated by the Financial Conduct Authority and operates under additional international regulators, ensuring a strong compliance framework and high client fund protection.

Client funds are held in segregated accounts and protected under the FSCS scheme up to £85,000, with additional private insurance coverage of up to £1,000,000 per client.

After ActivTrades registration, the broker provides access to over 1,000 tradable instruments, including Forex pairs, indices, commodities, shares, ETFs, bonds, and cryptocurrencies.

With spreads starting from 0.5 pips, no minimum deposit requirement, Islamic accounts, and professional leverage up to 1:400, ActivTrades is positioned as a regulation-focused broker suitable for both retail and professional traders.

Account Types | Individual, Professional, Demo, Islamic |

Regulating Authorities | FCA, SCB, CMVM, BACEN, CVM |

Minimum Deposit | $0 |

Deposit Methods | Bank Wire, Credit/Debit Cards, Skrill, Neteller, Local Payments |

Withdrawal Methods | Bank Wire, Credit/Debit Cards, Skrill, Neteller, Local Payments |

Maximum Leverage | Up to 1:400 (Professional accounts) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, ActivTrader |

ActivTrades Pros and Cons

The table beneath highlights the most important strengths and weaknesses of ActivTrades.

Pros | Cons |

Regulated by FCA and multiple international authorities | No copy trading or PAMM services |

Strong client fund protection and additional insurance | Not available to US traders |

No minimum deposit requirement | Limited promotional bonuses |

Wide range of tradable instruments (1,000+) | Leverage restricted for retail clients |

Multiple platforms including TradingView | — |

FBS

FBS is a global Forex and CFD broker established in 2009, serving more than 27 million users worldwide. The broker operates through multiple regulated entities, including a CySEC-licensed European branch and an offshore entity regulated by the FSC, allowing it to offer flexible trading conditions to international clients.

Client funds in FBS dashboard are held in segregated accounts, and negative balance protection is applied across supported regions.

FBS provides access to over 550 tradable instruments across Forex, indices, commodities, metals, shares, and cryptocurrencies.

Alongside FBS rebate, the broker offers floating spreads starting from 0.7 pips with zero trading commission, making it attractive for cost-sensitive traders. Traders can use MetaTrader 4, MetaTrader 5, and the proprietary FBS mobile app, which includes more than 90 technical indicators.

With a very low minimum deposit of $5, leverage reaching up to 1:3000 via offshore regulation, 24/7 customer support, and Islamic account availability, FBS is positioned as a beginner-friendly yet flexible broker for global traders.

Account Types | Standard, Demo, Islamic |

Regulating Authorities | CySEC, FSC |

Minimum Deposit | $5 |

Deposit Methods | Bank Transfer, Credit/Debit Cards, E-payment Systems |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards, E-payment Systems |

Maximum Leverage | Up to 1:3000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, FBS Mobile App |

FBS Pros and Cons

Below, a structured table compares the main pros and cons of FBS as a broker.

Pros | Cons |

Very low minimum deposit ($5) | Only one live account type available |

Regulated by CySEC and FSC | Not available in EU, UK, US, and some regions |

Zero trading commission | No copy trading or PAMM services |

High leverage up to 1:3000 | Limited account diversity |

User-friendly mobile app with 90+ indicators | Offshore regulation for high leverage |

24/7 multilingual customer support | — |

easyMarkets

easyMarkets is a multi-regulated Forex and CFD broker known for its beginner-friendly environment, fixed and variable spread models, and innovative risk-management tools.

Founded in 2001 and headquartered in Cyprus, the broker operates under several regulators, including CySEC, ASIC, FSCA, FSA Seychelles, and FSC BVI, which allows it to serve both retail and international clients.

One of easyMarkets’ key differentiators is its proprietary trading platform, which offers unique features such as dealCancellation and Freeze Rate, designed to reduce execution risk during volatile market conditions. These features are available for all traders after easyMarkets registration.

The broker provides commission-free trading, a low minimum deposit of $25, and access to over 200 instruments across Forex, indices, commodities, metals, cryptocurrencies, shares, and options.

With leverage reaching up to 1:2000 for non-EU clients and strong negative balance protection, easyMarkets positions itself as a solid choice for both new and risk-aware traders.

Account Types | Standard, Premium, Demo, Islamic |

Regulating Authorities | CySEC, ASIC, FSA, FSC, FSCA |

Minimum Deposit | $25 |

Deposit Methods | Credit/Debit Cards, Bank Wire, Skrill, Neteller, Online Payment Systems |

Withdrawal Methods | Credit/Debit Cards, Bank Wire, Skrill, Neteller, Online Payment Systems |

Maximum Leverage | Up to 1:2000 (Non-EU clients) |

Trading Platforms & Apps | Proprietary Platform, MetaTrader 4, MetaTrader 5, TradingView |

easyMarkets Pros and Cons

The following table gives readers an at a glance summary of easyMarkets broker pros and cons.

Pros | Cons |

Regulated by multiple authorities (CySEC, ASIC, FSCA, FSA, FSC) | Limited number of tradable assets compared to top ECN brokers |

Very low minimum deposit ($25) | No true ECN or RAW spread account |

Commission-free trading model | Fixed spreads can be wider during low liquidity |

Unique risk-management tools (dealCancellation, Freeze Rate) | No copy trading or PAMM solutions |

Supports MT4, MT5, TradingView, and proprietary platform | 24/5 support only, not 24/7 |

High leverage options for non-EU clients | Geo-restrictions in several countries |

What is the SCM Regulation?

The Securities Commission Malaysia or SCM is the primary financial regulatory authority responsible for overseeing capital markets and financial intermediaries in Malaysia.

In the context of Forex trading, SCM does not directly license most offshore retail Forex brokers. Instead, it regulates licensed financial institutions, investment banks, and capital market service providers operating locally.

As a result, many Malaysian traders legally access international brokers regulated by foreign authorities while SCM focuses on warning against unlicensed or fraudulent entities.

Key objectives of SCM include

- Supervising licensed financial institutions

- Enforcing compliance with Malaysian financial laws

- Issuing public alerts against illegal Forex schemes

- Promoting investor education and risk awareness

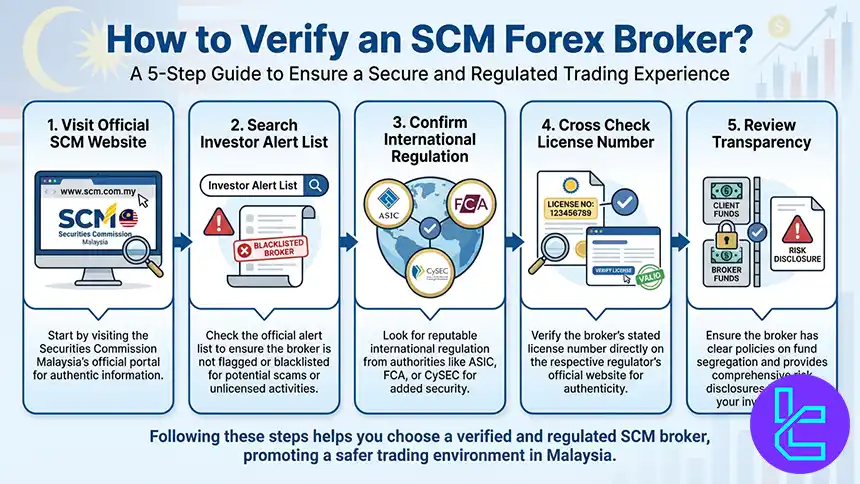

How to Verify an SCM Forex Broker?

Verifying a Forex broker under Malaysian regulatory standards requires checking both local and international credentials. Since most retail Forex brokers are not directly licensed by SCM, verification focuses on legitimacy rather than local authorization. Steps to verify a broker include.

- Visit the official website of the Securities Commission Malaysia

- Search the Investor Alert List to ensure the broker is not blacklisted

- Confirm the broker’s international regulation such as ASIC, FCA, or CySEC

- Cross check the license number on the regulator’s official website

- Review transparency on fund segregation and risk disclosures

If a broker claims local authorization, its name must appear in SCM’s list of licensed entities. Absence from the warning list combined with strong foreign regulation is generally considered acceptable for Malaysian traders.

Forex Trading in Malaysia

Forex trading in Malaysia is widely practiced by retail and professional traders despite regulatory nuances. While local regulation is strict regarding domestic Forex solicitation, Malaysian residents are legally allowed to trade through internationally regulated brokers.

The market is dominated by online trading platforms offering access to global currency pairs, CFDs, commodities, indices, and cryptocurrencies. Traders typically rely on brokers regulated by authorities such as ASIC, FCA, or CySEC due to the limited number of locally licensed Forex providers.

Education, risk management, and broker verification are essential due to the presence of unlicensed investment schemes targeting local traders.

What are the Important Factors for Choosing the Best Forex in Malaysia?

Selecting a Forex broker in Malaysia requires a methodical, data focused approach, as traders rely on these platforms to safeguard and execute their capital. The TradingFinder evaluation framework focuses on factors that directly impact trading safety and performance.

- Regulation and licensing to confirm legal operation and client protection;

- Trading costs, including spreads, commissions, and non-trading fees;

- Account types and tradable instruments to match different trading strategies;

- Trading platforms and apps, such as MT4, MT5, and mobile solutions;

- Deposits, withdrawals, and verification speed for smooth account management;

- Customer support quality and Trustpilot feedback as real trust indicators.

These criteria help Malaysian traders compare brokers objectively and select platforms aligned with their trading goals.

Is Forex Trading Legal in Malaysia?

Forex trading is legal in Malaysia for individuals who trade through properly regulated international brokers. However, offering Forex trading services or managing client funds without authorization from the Securities Commission Malaysia or Bank NegaraMalaysia is illegal.

- Individual trading with offshore brokers is permitted

- Local Forex brokers must be licensed by Malaysian authorities

- Forex investment schemes and signal selling without approval are prohibited

- SCM actively issues warnings against illegal operators

Malaysian traders must ensure they are not participating in locally promoted Forex programs that promise guaranteed profits. Personal trading through foreign regulated platforms remains lawful as long as no domestic solicitation laws are violated.

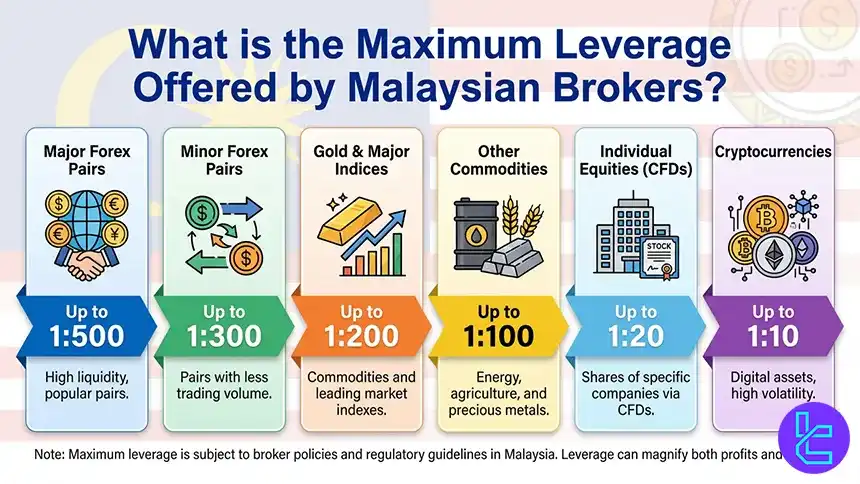

What is the Maximum Leverage Offered by Malaysian Brokers?

Forex brokers accessible to Malaysian traders operate under guidelines issued by the Securities Commission Malaysia (SCM).

Unlike ESMA-regulated jurisdictions in Europe, Malaysia does not enforce a single, fixed retail leverage cap. Instead, leverage limits depend on the broker’s regulatory license, client classification, and risk management policies.

SCM emphasizes risk disclosure, suitability assessment, and fair dealing, allowing brokers to offer higher leverage while requiring clear communication of associated risks. As a result, leverage levels in Malaysia are generally more flexible compared to EU markets.

Asset Class | Typical Maximum Leverage |

Major Forex Pairs | Up to 1:500 |

Minor Forex Pairs | Up to 1:300 |

Gold & Major Indices | Up to 1:200 |

Other Commodities | Up to 1:100 |

Individual Equities (CFDs) | Up to 1:20 |

Cryptocurrencies | Up to 1:10 |

Is Negative Balance Protection Available in SCM-Regulated Forex Brokers?

Negative Balance Protection is not explicitly mandated by SCM because most retail Forex brokers serving Malaysians are regulated abroad. However, this protection is commonly provided by brokers regulated under strict international frameworks.

For Malaysian traders, availability of Negative Balance Protection depends on the broker’s foreign license, not SCM rules.

Choosing brokers that explicitly guarantee this feature is critical, especially when trading with leverage or during volatile market conditions.

How is the Taxation of SCM Regulated Forex Brokers?

Malaysia does not impose a specific capital gains tax on Forex trading profits for individual traders. However, taxation depends on the nature of trading activity and income classification.

- Occasional retail trading profits are often tax free

- Professional or high frequency trading may be treated as taxable income

- Income derived from Forex related services may be subject to tax

- Corporate trading accounts follow business taxation rules

SCM does not directly tax traders but cooperates with Malaysian tax authorities. Traders with significant or consistent profits should consult a local tax professional to ensure compliance with Malaysian income tax regulations.

Forex Trading in Malaysia Compared to Other Countries

Forex trading in Malaysia operates under a more restrictive and compliance focused framework compared to several other Asian and Middle Eastern markets. Oversight is primarily handled by the Securities Commission Malaysia (SCM), which prioritizes investor protection, capital controls, and strict licensing standards.

In contrast, countries such as India, UAE, and Indonesia apply different regulatory models, ranging from highly restrictive domestic rules to more flexible international brokerage access.

The comparison below highlights how Malaysia stands relative to these markets in terms of regulation, leverage, broker accessibility, and trader protection.

Comparison Factor | Malaysia | |||

Primary Regulator | Securities Commission Malaysia (SCM) | Reserve Bank of India (RBI), SEBI | Securities and Commodities Authority (SCA), DFSA | BAPPEBTI |

Regulatory Framework | National regulation with strict FX controls | Highly restricted retail FX trading | Regulated with free zone frameworks | National regulation with licensed local brokers |

Retail Leverage Cap Forex Majors | Up to 1:500 (via offshore brokers) | Not officially defined (FX largely restricted) | Up to 1:30 (DFSA), higher offshore | Up to 1:100 |

Investor Protection Level | Medium | High (capital controls) | High | Medium |

Negative Balance Protection | Broker dependent | Not standardized | Mandatory under DFSA | Broker dependent |

Client Fund Segregation | Required for licensed entities | Mandatory for regulated entities | Mandatory | Mandatory |

Broker Transparency Requirements | High compliance standards | Very strict | Very strict | Moderate |

Broker Availability | Limited local, broad offshore access | Very limited | Broad local and international | Mainly local brokers |

Access to International Brokers | Restricted but common via offshore | Highly restricted | High global access | Limited |

Typical Trading Platforms | MT4, MT5, WebTrader | Limited access | MT4, MT5, cTrader, TradingView | MT4, MT5 |

Maximum Loss Protection | Depends on broker policy | Capital restricted environment | Cannot lose more than deposit | Depends on broker |

Tax Treatment of Forex Profits | Subject to income tax | Taxed as income or business gains | Generally tax free for individuals | Taxable under income rules |

Conclusion

Forex trading in Malaysia operates within a strict regulatory and compliance driven environment, overseen by the Securities Commission Malaysia.

While local licensing for retail Forex brokers is limited, Malaysian traders commonly access global markets through internationally regulated brokers supervised by authorities such as the Financial Conduct Authority, Australian Securities and Investments Commission, and Cyprus Securities and Exchange Commission.

Selecting the best Forex broker in Malaysia depends on regulatory credibility, trading costs, platform quality, leverage structure, and risk protection features such as segregated funds and negative balance protection.

Broker rankings are established through a comprehensive evaluation process defined by the TradingFinder forex methodology, which analyzes key factors such as regulatory standing, trading fees, and the range of available account types to ensure objective and data driven comparisons.